Morning Download from Invincible Money

Personal finance + economics + markets

Finance in 5 minute a day to help you make better money decisions.

Good morning investors! We’re excited about the new Apple headset, consumer debt reached an all-time high, institutional investors have been selling stocks and a reminder to invest for the long-term.

📊 Economy

The New York Fed reports U.S. consumer debt hit an all-time high of of $17 Trillion in Q1 2023. That’s even considering mortgage demand is the lowest since 2014.

During the pandemic 14 million mortgages were refinanced, but that surge is over and refinance applications are down 44% compared to last year.

"During the pandemic, mortgage borrowers reduced their annual payments by tens of billions of dollars, providing additional funding for spending or paydowns in other debt categories,” - the New York Fed said.

🏛️ The president of the Atlanta Fed doesn’t predict any rate cuts through the rest of this year, even if we enter a recession. He said reducing inflation should be the #1 priority of the Fed.

“If there’s going to be a bias to action, for me it would be a bias to increase a little further as opposed to cut,” said Atlanta Fed President Bostic.

The CME Group’s FedWatch Tool gives a 0.4% chance interest rates will remain where they are by end of the year.

Minneapolis Fed President Kashkari said they have “more work to do…to bring down inflation.” (ya think?!)

🚙 Thanks to higher interest rates, Americans are keeping their old cars longer. The average age of a car on the road is now 12.5 years after the average rose 3 months.

Stock pickers may want to look at auto repair and parts dealers who may benefit.

📰 News

💍 The World Platinum Investment Council said a platinum shortage will be worse than expected thanks to an increase in demand. Platinum was trading at around $1,070 yesterday after reaching a high of $1,130 in April.

💰The IRS is making big moves in tax prep, announcing a free e-filing prototype. They’re testing it now and it could be available in January. It’s funded through the Inflation Reduction Act.

Should Turbo tax (owned by Intuit) and others worry? Well, the IRS already offers no-fee filing through several companies, but less than 3% of people use the service.

Intuit [INTU -0.47%] stock was unphased after initially falling on Monday’s open.

📈 Stocks

🍎 Apple is expected to release a mixed reality headset in 2023 that will be powered by two M2 chips and have a high-resolution display.

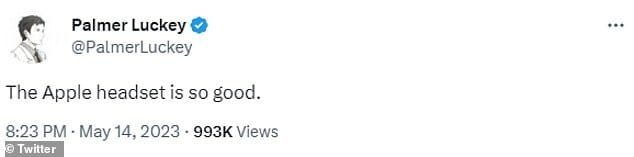

Early testers say it “far exceeds” products from competitors, even Lucky Palmer who sold Oculus to Meta said it’s “so good.”

The headset will be compatible with the iPhone and Mac and will be used for gaming, watching movies, and working in virtual reality.

Apple is also rumored to be working on a pair of AR glasses that are expected to be released in 2024.

We may see a demo next month at Apple’s Developer Conference.

🇪🇺 EU regulators approved Microsoft’s $69 B acquisition of Activision Blizzard (owners of Warcraft and Call of Duty). This is good news after the UK blocked the deal. Microsoft is trying to catch up to Sony and Nintendo who are both outselling them in the consoles race.

📉 For the past 12 months institutional investors have been getting out of stocks. Make of this what you will.

🏋🏻♀️ Meanwhile, a top analyst at JP Morgan reiterated his underweight call for US and EU equities.

An underweight recommendation is based on the belief that the stock's potential for returns is relatively weaker compared to other investment opportunities.

🔐 Crypto

An interesting poll was published by Bitcoin Magazine with all the talk about the debt ceiling. They claim investors prefer Bitcoin over the dollar. I’d love to know what you think. Take our poll below.

Do you agree?

💰 Be a Better Investor

"Investing is not about predicting the future, it's about controlling the downside."

In the market, it is impossible to predict the future with certainty. However, investors can control their downside risk by investing in quality companies with strong fundamentals and by diversifying their portfolios. By doing these things, investors can increase their chances of achieving their financial goals over the long term.

💵 Personal Finance

Remember these timeless investing principles. Everyone forgets, especially during bull markets or when we see something shiny.

Invest for the long term. Don't try to time the market or make quick profits. Instead, focus on buying quality companies and holding them for the long term. This will help you to achieve your financial goals and avoid making costly mistakes.

The stock market is a long-term game. Prices can fluctuate significantly in the short term, but over the long term, the stock market has always trended upwards. This is because businesses tend to grow over time, which leads to higher earnings and stock prices.

About 95% of day traders lose money. Increase your odds by investing for the long term.

Don't try to time the market. It is impossible to predict when the market will go up or down. Trying to time the market is a sure way to lose money. Instead, focus on buying quality companies and holding them for the long term.

Diversify your portfolio. By diversifying your portfolio, you can reduce your risk. Diversification means investing in a variety of different assets, such as stocks, bonds, and real estate. This helps to spread risk across different asset classes and reduces the likelihood of losing all of your investment in any one asset.

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.