Morning Download from Invincible Money

Personal finance + economics + markets

Good morning investors! It’s a busy week with earnings season starting and the Fed expected to hike rates one more time.

Today we cover:

Hike or no hike?

Banks cooking the books (again)

$1.1 billion to play football/soccer for a year?

Worldcoin takes off

Short-term investments for you

📊 Economy

Hike or no hike?

Rates are this high!

The stock market has been on a tear this year and is now 5% from breaking its all-time high.

Some are wondering if the US Federal Reserve will end its series of interest rate hikes despite the recent stock market rally.

However, there are a number of factors that could still lead the Fed to continue hiking rates. These include the ongoing war in Ukraine, which could continue to drive up energy prices and inflation. Additionally, the strong labor market could also keep inflation elevated, as businesses are forced to raise wages to attract and retain workers.

The Fed’s tight spot:

The Fed is likely to be very cautious about ending its rate-hiking campaign too soon. If they do, and inflation does not start to come down, they may have to reverse course and start hiking rates again. This could lead to market volatility and economic uncertainty.

The Fed is also likely to be mindful of the impact that rate hikes have on the housing market. The housing market is already starting to cool, and if rates continue to rise, it could lead to a more significant slowdown. This could have a ripple effect on the economy, as the housing market is a major driver of economic growth.

My take: It is too early to say whether or not the Fed will end its rate-hiking campaign. The decision will likely depend on a number of factors, including the state of the economy, the trajectory of inflation, and the performance of the stock market.

Wall Street says: Economists on Wall St. are betting the Fed raises 0.25% one final time on Wednesday, but they aren’t ready to say it’s the last one.

📰 News

Banks cooking books again

The FDIC has warned U.S. banks against manipulating their deposit numbers following Silicon Valley Bank's financial troubles.

What did they do? After the collapse of SVB, 47 banks restated their December 31 uninsured-deposit figures downward by a total of $198 billion.

Bank of America and Huntington National Bank made the most significant revisions, reducing their uninsured deposits by $125 billion (14%) and $34 billion (40%), respectively.

The FDIC emphasized that only deposits insured by them should be classified as insured, regardless of the presence of collateral. Such adjustments in deposit figures could lead to substantial savings on the special assessment imposed by the FDIC on larger banks to cover the costs of guaranteeing uninsured deposits at failed banks.

Summary: banks tried to restate their uninsured numbers to look better and save on insurance costs.

🤔 I’m old enough to remember 2 weeks ago when Bank of American was fined $250 million for creating fake bank accounts, overcharging customers and withholding credit rewards.

Soccer is wild:

⚽️ Saudi Arabia football (soccer) club Al-Hilal is offering striker Kylian Mbappe $1.1 billion for a ONE YEAR deal! …I don’t understand the world anymore.

📈 Stocks

S&P 500 4,554.64 (+0.40%)

DJIA 35,411.24 (+0.52%)

NASDAQ 14,058.87 (+0.19%)

VIX 13.91 (+2.28%)

11 Day winning streak!

The DOW continued its longest streak since 2017!

Fun Fact: An 11 day record happens about once every decade. This is the 6th time it’s happened since 1945.

Most Active

🍿AMC Entertainment Holdings, Inc. [AMC +32.95%] took off after a judge blocked the company from a plan to convert APE shares into common stock, which would have diluted the stock. Also, the “Barbenheimer” effect gave it a boost.

Sirius XM Holdings Inc. [SIRI -15.25%] had a serious reversal after being up big last week, then downgraded by 2 Wall Street analysts said the stock is too high.

Tesla, Inc. [TSLA +3.48%] was up despite being downgraded from “buy” to “neutral” by UBS, signaling concern at the current valuation.

🔐 Crypto

Bitcoin $29,117.47 (-3.3%)

Ethereum $1,849.10 (-2.2%)

Total market cap $1.21 T (-2.9%)

* Prices as of July 24th, 8:10 PM UTC

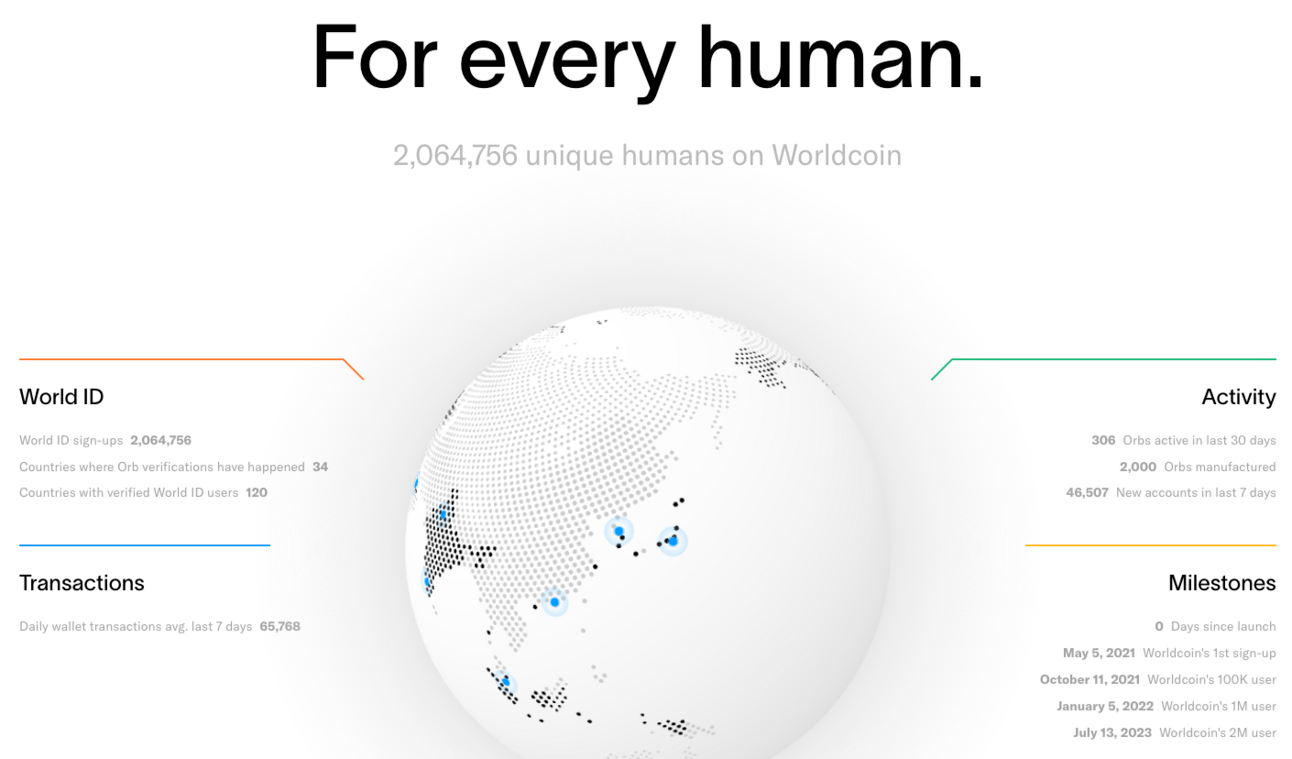

Worldcoin Launches

The founder of OpenAI (maker of ChatGPT) launched his cryptocurrency, called Worldcoin (WLD +29.8%).

It traded up nearly 30% on its first day and reached a market cap of $231 million.

What is it?

The token is distributed weekly to anyone who has scanned their iris to an “Orb” device. Worldcoin got some bad press least year when they started scanning people because people thought it was a creepy idea to have your eye scanned. 👀

Eye scan? The idea is to use an eye scan to tie someone to the coin, instead of KYC.

2 million people have already done it though. It’s not available in the U.S. yet.

Altman said he considers it a pre-cursor to Universal Basic Income, which he’s a big proponent of.

Here’s an interview with the founders if you want to learn more.

💵 Personal Finance

Different types of short-term investments

Every wonder what the difference is between different places to store your cash, other than a bank account? Let’s cover 3 types: Short-term bond, CD (certificate of deposit) and Money Market Fund.

Short-term bond: A debt security that matures in less than one year. Low risk, low interest rate. Issued by a company or government.

CD: A type of savings account that offers a higher interest rate than a traditional savings account. Low risk, guaranteed return in exchange for locking up your money for an agreed time. In the U.S. they’re insured by the FDIC up to $250,000.

Money market fund: A type of mutual fund that invests in short-term debt securities, such as Treasury bills, commercial paper, and certificates of deposit. Low to moderate risk, higher interest rate than a traditional savings account and you have access to your money. Not insured.

What’s right for you? The best investment for you will depend on your individual needs and risk tolerance. If you are looking for a low-risk investment with a guaranteed return, then a CD may be a good option for you. If you are looking for a higher interest rate and more liquidity, then a money market fund may be a better choice. And if you are looking for an investment with the potential for higher returns, then a short-term bond may be a good option.

💰 Be a Better Investor

"The four most dangerous words in investing are 'this time it's different.'"

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.