Good morning investors! This is going to be a busy and exciting week as some big names are set to announce earnings and we might get more updates on the rate cut and Middle East situation.

Also, the Bitcoin network has completed the fourth-ever ‘halving’ of rewards to miners, but BTC is still under $65,000.

Today we cover:

Things to keep an eye on this week

Big tech earnings

Tesla is in trouble

📊 Economy and News

Things to watch out this week

Not just big tech earnings, some other exciting things are also expected this week:

Inflation data: Investors are closely watching U.S. inflation data this Friday, especially the personal consumption expenditures (PCE) price index, the Federal Reserve's preferred inflation measure.

Economists expect the PCE index to remain high in March. Recent indicators suggest that efforts to control inflation have stalled. This, along with strong labor market data, rising geopolitical tensions in the Middle East boosting oil prices, and comments from Fed officials, has led investors to reconsider the timing of potential rate cuts.

Other economic data this week includes the initial estimate of first quarter GDP, expected to show a slight moderation, along with figures on new home sales, initial jobless claims, and revised numbers on consumer sentiment and inflation expectations.

Oil: Oil prices settled slightly higher on Friday but recorded a weekly decline as Iran played down Israel's retaliatory drone strike, easing concerns of Middle East conflict escalation.

Prices fell around 3% last week, their largest weekly drop since February, as the risk premium on oil decreased.

Investors remain cautious about potential supply disruptions. The International Monetary Fund expects OPEC+ to start increasing oil output from July.

In addition, investors are eagerly awaiting Tuesday's release of Purchasing Managers' Index (PMI) data for the Eurozone, the U.S., and the UK, looking for signs of inflation, particularly in the services sector.

Also, Investors will be on the look-out for clues on timing of the next rate hike when the BOJ releases fresh quarterly growth and inflation forecasts at its policy meeting on Friday.

Global hits:

Elon Musk postpones India visit, citing Tesla obligations.

VW workers in Tennessee vote to join UAW in historic win for Detroit union.

Trump Media warns Nasdaq of suspected market manipulation.

📈 Stocks

S&P 500 4,967.23 (-0.88%)

DJIA 37,986.40 (+0.56%)

NASDAQ 17,037.65 (-2.05%)

BRENT CRUDE 87.22 (-0.03%)

* Prices as of Mar Apr 22nd, 12:20 AM UTC

Big names set to report earnings

The content below originally appeared in this week’s Pro version in the Investment of The Week section.

Be a part of the PRO today to get access to this exclusive content and enjoy many more benefits, like access to the “How to Make Money with AI” presentation.

Like always, new members get the first month for FREE.

We don’t have one top investment as some big names are set to announce earnings this week:

Tesla: Currently trading at $147.05, TSLA next reports on Apr 23 with an expected move of 8.78% by Apr 26 expiration. Down -40.81% YTD, the company is in a difficult position and a bad earnings report could cause it to fall below $140.

The options market overestimated TSLA stocks earnings move 42% of the time in the last 12 quarters. The predicted move after earnings announcement was ±7.3% on average vs an average of the actual earnings moves of 7.7% (in absolute terms).

The market expects Tesla to deliver a year-over-year decline in earnings on lower revenues when it reports results for the quarter ended March 2024.

The electric car maker is expected to post quarterly earnings of $0.46 per share. If it goes lower, the stock could crash by about 8%, but a positive report could help it grow as the company has been waiting on good news.

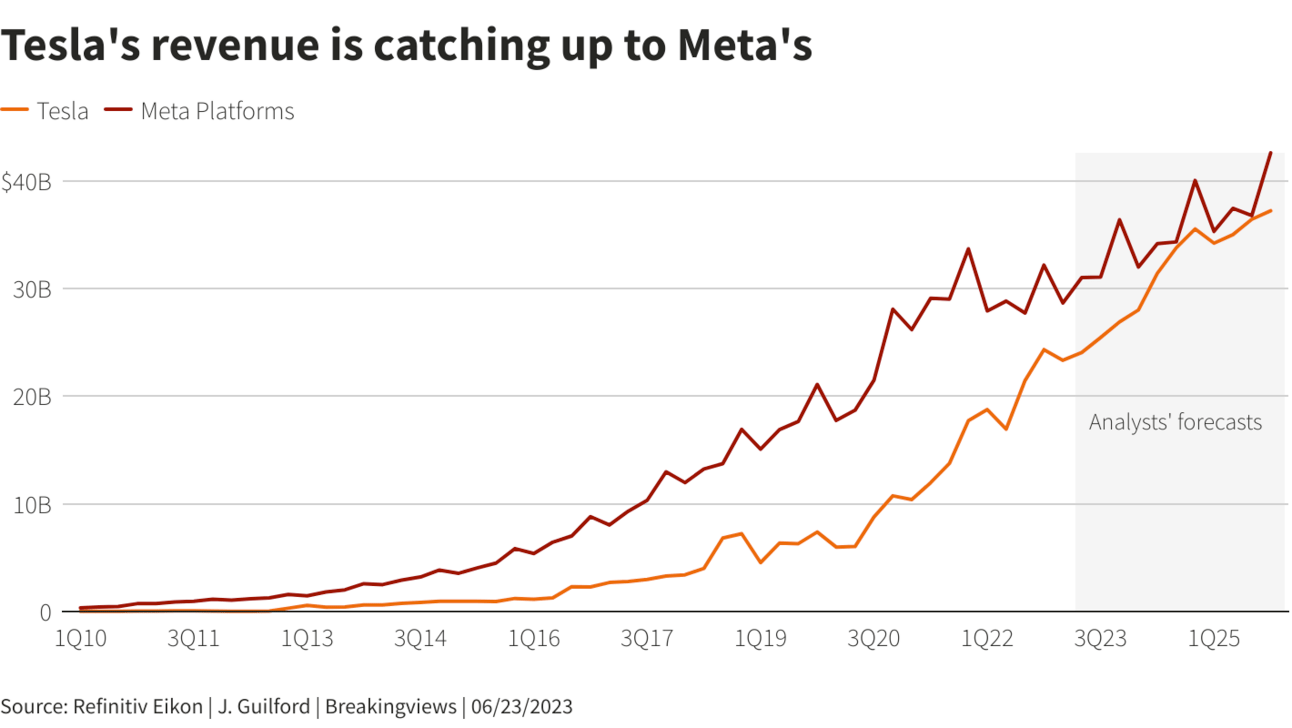

Meta: Meta is up 38.92% YTD but down about -12% from its 52-week high.

Set to report earnings on Apr 24, 2024, the company is still growing; however, analysts project Meta's revenue to be $36.24 billion for the first quarter of 2024, down from the previous quarter but up from $28.65 billion in the same period in 2023.

The options market overestimated META stocks earnings move 42% of the time in the last 12 quarters. The predicted move after earnings announcement was ±8.4% on average vs an average of the actual earnings moves of 12.9%.

We think a beat could help it gain 10%, which is close to what it has lost in the last few days to again get close to the 52-week high, but a negative report could cause it to lose over 12%.

Microsoft: This AI darling is expected to deliver a year-over-year increase in earnings on higher revenues when it reports results for the quarter ended March 2024.

The company has gained 7.62% YTD and is down -7.05% in the last past, trading at $399.12, close to its 52-week high of $430, which experts think it could cross this year if the company is able to report positive numbers this earnings season.

The options prices predicted a ±4.7% post earnings move, compared to a -2.7% actual move. The options market overestimated MSFT stocks earnings move 69% of the time in the last 13 quarters. The predicted move after earnings announcement was ±4.7% on average vs an average of the actual earnings moves of 3.6%.

Warning: The current scenario is unpredictable due to the geopolitical situation. Plus, pressure from high interest rates could also impact stocks, so tread carefully this week.

Tesla issues: Tesla has been ordered to recall nearly 4,000 of its Cybertrucks due to an accelerator pedal that can stick in place when pressed down.

Also, the company is cutting prices again. The company unveiled price cuts over the weekend in China and in the United States, and now it will cut prices of some models in Germany and elsewhere in Europe, the Middle East and Africa.

Lastly, Tesla on Saturday slashed the price of its Full Self-Driving driver assistant software to $8,000 from $12,000 in the United States.

\💵 Personal Finance

Use AI to make money – Part II

Here’s part two of our making money with AI series:

Analyze and Interpret Customer Patterns

AI makes it easy to work with data, which can be very useful for people who manage a business. Back in the day, it took hours and days to analyze data and draw conclusions, but now with AI this can be done in just a few minutes.

So, if you are a business owner, you can use AI to analyze customer patterns and make decisions accordingly. It can be used to identify customers with a lot of potential, products that are likely to sell, hours that your business performs better, etc.

Your job will be to gather customer data, and the AI will do the rest. This feature can be used even if you do not have your own business.

One of our favorites is Cortex. Used by global brands like Marriott, Kraft Heinz, and L’Oréal Pari, it focuses on visual content creation for different channels, including social media platforms, websites, and email.

Cortex’s workflow can reduce the time and money spent on A/B testing so users can allocate those resources to more value-added tasks. It also offers white-label and brief creation services. Another tool we like is Polymer, which is free to use, and comes with the ability to analyze spreadsheets in seconds.

💰 Be a Better Investor

“Good advice is never as helpful as an interest-free loan.”

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.