Buying stocks – before or after earnings?

When trading around earnings reports, it's crucial to understand that the market's reaction to these reports can be highly unpredictable.

Even if a company posts strong earnings, the stock might still decline due to factors like unmet market expectations or broader economic conditions.

Conversely, a company might report weaker earnings, but if the market had anticipated worse results, the stock could actually rise. This highlights the importance of not just analyzing the earnings report itself, but also understanding the expectations and sentiment surrounding the stock before the report is released.

Here’s a summary:

If you believe a company will post strong earnings and expect the stock to rise after the announcement, you could purchase the stock beforehand.

If you believe a company will post disappointing earnings and expect the stock to decline after the announcement, you could short the stock.

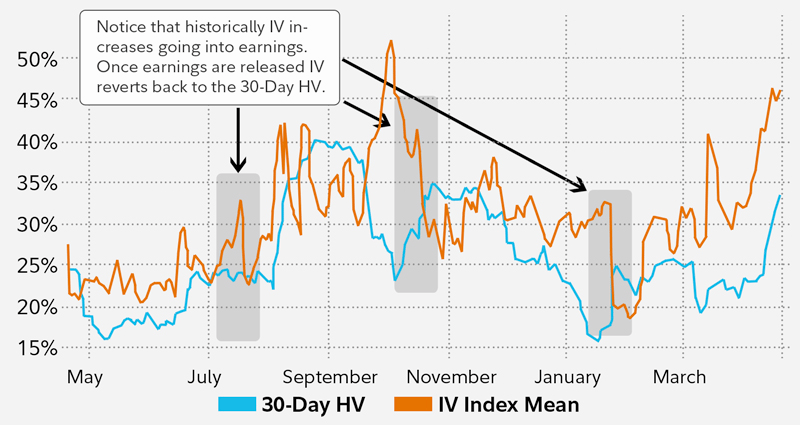

To navigate this complexity, investors should consider a range of tools and strategies. One approach is to use options trading, which allows you to hedge your bets and limit potential losses. For instance, if you're confident in a positive earnings surprise but want to protect against a downside, you might buy a call option while also buying a put option (a strategy known as a straddle). This way, you can benefit from significant price movements in either direction.

It's also essential to pay attention to the broader market context and sector trends. Sometimes, a company's earnings report might reflect issues that are industry-wide, meaning similar companies could be affected in similar ways. Monitoring news, analyst reports, and market sentiment leading up to the earnings release can provide additional insights into how the stock might move.

For example, a bad report from Boeing could impact Airbus as well and vice versa. Now, in some cases, a bad report from Boeing could also positively impact Airbus, if it shows that Airbus is in a better position than Boeing.

Newsletters like Bullseye Trades offer daily stock and options ideas, especially for day traders.

Created by trading genius, Jeff Bishop, this newsletter offer free hints and has proven to be quite a success.

Those interested in solid signals can also check our weekly Pro issue that contains two sections:

A stock report with a 12-month price target indicating whether it’s a buy, sell, or hold.

An Investment of the Week section that is suitable for day traders and highlights a specific asset that’s likely to go up or down in the week.

Finally, it's important to remember that not all post-earnings stock movements are permanent. Stocks often experience temporary volatility after earnings reports, followed by a return to more stable prices as the market digests the new information. For this reason, some investors prefer to wait until the initial post-earnings reaction subsides before making any trades, allowing them to avoid the whiplash of short-term price swings.

Warning: A company’s earnings report is a crucial time of year for investors. Expectations can change or be confirmed, and the market may react in various ways. If you are looking to trade earnings, do your research and know what tools are at your disposal.