Good morning investors! The market took a turn yesterday and closed lower.

Today we cover:

A look at the housing market

Stocks take a break

More earnings

📊 Economy and News

A look at the housing market

Sales of previously owned homes increased by 1.3% in July from June, reaching a seasonally adjusted annual rate of 3.95 million units. This marked the first increase in five months.

However, sales were down 2.5% compared to the same period last year.

The Northeast experienced the largest sales growth, while the Midwest remained unchanged. Home prices also saw the most significant rise in the Northeast.

These sales are based on contracts that were likely signed in May and June, when mortgage rates were well over 7% on the popular 30-year fixed loan. Rates began dropping in July and are now hovering around 6.5%.

All-cash offers accounted for 27% of home sales in July, up from 26% the previous year and significantly above the historical average.

First-time buyers represented 29% of July sales, the same as in June but down from 30% in July 2023. Traditionally, first-time buyers make up closer to 40% of home sales, but affordability has been significantly impacted over the past two years by rapidly rising home prices and higher mortgage rates.

Inventory: The supply of homes on the market continued to rise in July, with 1.33 million houses available by the end of the month. This was a 0.8% increase from June and 19.8% higher than in July 2023. At the current sales rate, this supply would last for four months, slightly less than in June.

Prices: Despite the increased supply, home prices did not cool off. The median price of an existing home sold in July was $442,600, reflecting a 4.2% increase compared to the previous year.

Global hits:

Canadian railways grind to a halt as workers locked out; economic fallout fears rise.

McDonald’s could create 24,000 jobs at new stores in UK and Ireland.

China’s self-driving startup WeRide delays U.S. IPO as deadline looms.

📈 Stocks

S&P 500 5,570.64 (-0.89%)

DJIA 40,712.78 (-0.43%)

NASDAQ 17,619.35 (-1.67%)

BRENT CRUDE 77.13 (+1.46%)

* Prices as of Aug 23rd, 12:20 AM UTC

Stocks fall as earnings continue

The S&P 500 declined on Thursday as investors awaited a speech by Federal Reserve Chair Jerome Powell at the central bank's annual Jackson Hole conference.

This downturn comes after a largely positive stretch that had been viewed as a recovery rally following the global market turmoil on August 5. Earlier in the session, all three major indexes had been trading higher, with the S&P 500 nearing its all-time intraday high from July before reversing direction.

Stocks faced downward pressure due to rising bond yields and weakness in technology stocks on Thursday. The 10-year U.S. Treasury yield rose nearly 9 basis points to 3.863%, contributing to the S&P 500's decline, with the information technology sector dropping more than 2%, highlighting the sector's vulnerability.

As a result of Thursday's losses, the Nasdaq ended the week just below flat, while the Dow and S&P 500 remained up by 0.1% and 0.3%, respectively.

Earnings: Snowflake, a software company, fell -14.7% as increasing costs impacted its operating margins, despite beating quarterly expectations and slightly raising its full-year product revenue forecast.

Urban Outfitters also declined, dropping -9.6% after reporting disappointing growth in second-quarter same-store sales.

Cava jumped +10% after beating Wall Street’s estimates for its quarterly earnings and revenue. The Mediterranean restaurant chain said its fiscal second-quarter traffic climbed 9.5%, bucking industry trends. The company also raised its full-year forecast.

Good to know: Deutsche Bank shares rise 4% after settlement of bulk of claims in long-running Postbank suit.

Vaccines pop: Bavarian Nordic shares pop over 13% on earnings beat, bumper mpox vaccine order. On the other hand, The FDA has approved updated Covid vaccines from Pfizer and Moderna, putting the shots on track to reach most Americans in the coming days as the virus surges. The CDC recommended that everyone over 6 months old receive an updated Covid vaccine this year.

💵 Personal Finance

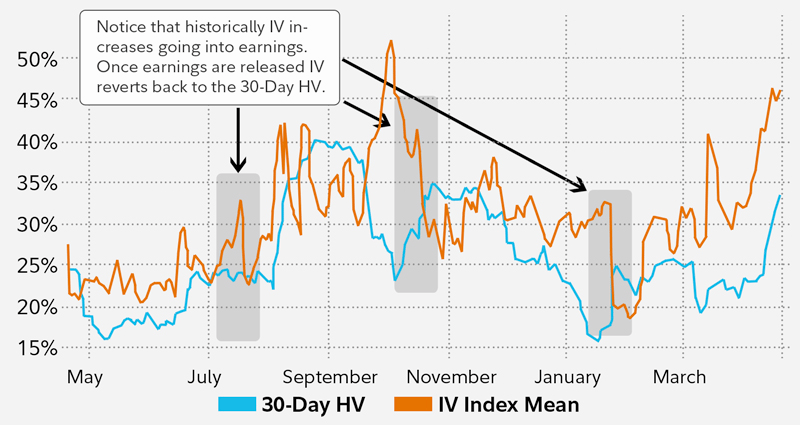

Buying stocks – before or after earnings?

When trading around earnings reports, it's crucial to understand that the market's reaction to these reports can be highly unpredictable.

Even if a company posts strong earnings, the stock might still decline due to factors like unmet market expectations or broader economic conditions.

Conversely, a company might report weaker earnings, but if the market had anticipated worse results, the stock could actually rise. This highlights the importance of not just analyzing the earnings report itself, but also understanding the expectations and sentiment surrounding the stock before the report is released.

Here’s a summary:

If you believe a company will post strong earnings and expect the stock to rise after the announcement, you could purchase the stock beforehand.

If you believe a company will post disappointing earnings and expect the stock to decline after the announcement, you could short the stock.

To navigate this complexity, investors should consider a range of tools and strategies. One approach is to use options trading, which allows you to hedge your bets and limit potential losses. For instance, if you're confident in a positive earnings surprise but want to protect against a downside, you might buy a call option while also buying a put option (a strategy known as a straddle). This way, you can benefit from significant price movements in either direction.

It's also essential to pay attention to the broader market context and sector trends. Sometimes, a company's earnings report might reflect issues that are industry-wide, meaning similar companies could be affected in similar ways. Monitoring news, analyst reports, and market sentiment leading up to the earnings release can provide additional insights into how the stock might move.

For example, a bad report from Boeing could impact Airbus as well and vice versa. Now, in some cases, a bad report from Boeing could also positively impact Airbus, if it shows that Airbus is in a better position than Boeing.

Newsletters like Bullseye Trades offer daily stock and options ideas, especially for day traders.

Created by trading genius, Jeff Bishop, this newsletter offer free hints and has proven to be quite a success.

Those interested in solid signals can also check our weekly Pro issue that contains two sections:

A stock report with a 12-month price target indicating whether it’s a buy, sell, or hold.

An Investment of the Week section that is suitable for day traders and highlights a specific asset that’s likely to go up or down in the week.

Finally, it's important to remember that not all post-earnings stock movements are permanent. Stocks often experience temporary volatility after earnings reports, followed by a return to more stable prices as the market digests the new information. For this reason, some investors prefer to wait until the initial post-earnings reaction subsides before making any trades, allowing them to avoid the whiplash of short-term price swings.

Warning: A company’s earnings report is a crucial time of year for investors. Expectations can change or be confirmed, and the market may react in various ways. If you are looking to trade earnings, do your research and know what tools are at your disposal.

💰 Be a Better Investor

"Risk comes from not knowing what you're doing."

Resources:

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.