Morning Download from Invincible Money

Personal finance + economics + markets

5 minutes a day for better money decisions.

Good morning investors! 4 European countries hike rates, economists debate whether we’re in a recession, more big investment in EV and the Fed admits stablecoins are money.

📊 Economy

European Rate Hikes!

4 European central banks raised interest rates in an effort to combat persistent inflation.

Who raised?

Bank of England (up 0.50%) where consumer prices are still 8%+ and the index that doesn’t include energy reached a 31-year high.

Norway (up 0.50%) and promised more rate hikes to come.

Switzerland raised only 0.25% even though inflation is below 2%, signaling they don’t want to take a chance of inflation taking hold.

and…

🇹🇷 Turkey does a 180

Turkey’s central bank reversed course by increasing rates to 15% (almost double from 8.5%) while inflation is at nearly 40%. The country’s president, Erdogan, has been firmly against raising rates, but the new head of Turkey’s central bank seems to have convinced him otherwise.

Jobless claims up

The number of new jobless claims rose unexpectedly to 264,000 last week, the highest level since October 2021, signaling a loosening labor market.

Stats: The four-week moving average of jobless claims also rose to 255,750, the highest level since November 2021.

The increase in jobless claims includes layoffs in banking and tech, as well as slowing demand for temporary workers.

However, continuing claims, which measure the number of people who have been unemployed for more than 2 weeks, declined to 1.76 million. This suggests that some workers who have recently filed for unemployment benefits have been able to find new jobs.

David Rosenberg

Recession or Not?

Every day we hear analysts chime in about whether or not we’re in a recession. No one seems to agree.

Today it’s economist David Rosenberg comparing this market with the tech boom of 1999-2000, which was followed by the dot com bust.

He’s a former chief economist at Merrill Lynch, and said that the current tech stock frenzy reminds him of the dot-com bubble of the late 1990s.

His warning: The US economy is barreling towards a recession, as evidenced by the recent slowdown in economic growth and the rising inflation rate and investors appear overly optimistic, just like 25 years ago.

He also said that the Federal Reserve is "behind the curve" in its efforts to combat inflation, and that this could lead to a more severe recession. This has issue been raised by other economists as well.

His advice: Investors should be cautious and avoid putting too much money into the stock market right now.

📰 News

U.S. & Ford invest big in EVs

Yesterday, I wrote about Abu Dhabi investing $700 billion into China’s Nio. Now…

The U.S. is giving Ford a $9.2 billion loan to build three EV battery plants.

It’s the biggest government backing for a U.S. automaker since the bailouts in 2009 as the U.S. tries to reduce its battery reliance on China.

Ford hopes to produce 2 million EVs by 2026.

The plants are being built in Kentucky and Tennessee.

The total projected cost is $11.4 billion.

The EU cracks down on big tech

The European Union is setting up camp in San Francisco to fight against Big Tech.

The EU has opened an office in downtown San Francisco to oversee the enforcement of new rules aimed at reining in the power of tech giants.

The Digital Services Act (DSA) and the Digital Markets Act (DMA) are designed to make it harder for tech giants to abuse their market power.

The EU is concerned that Big Tech is too powerful and is not doing enough to protect users' privacy and data.

Interest rates drop, but mortgage demand is flat

The average interest rate for a 30-year fixed rate mortgage decreased to 6.73% from 6.77%.

Refinancing: Applications for refinancing fell 2% last week and are now 40% lower than this time last year.

New loans: Applications rose 2%, but are still down 32% from this time last year.

📈 Stocks

S&P 500 4,381.89 (+0.37%)

DJIA 33,946.71 (-0.01%)

NASDAQ 13,630.61 (+0.95%)

VIX 12.91 (-2.20%)

Virgin Galactic Raises $300 Million

Virgin Galactic [SPCE -6.83%] raised $300 million in a stock offering and plans to raise another $400 million in a private placement.

The company has yet to achieve commercial success, but it has made progress in recent months.

Virgin Galactic has more than 600 customers who have paid deposits for future flights. Each flight costs $450,000.

Who is Virgin Galactic?

The company was founded in 2004 by Richard Branson, with the first fully crewed spaceflight taking place in May, 2021.

The company has a goal of flying 400 customers per year by 2025.

Bed Bath & Beyond sells (sort of)

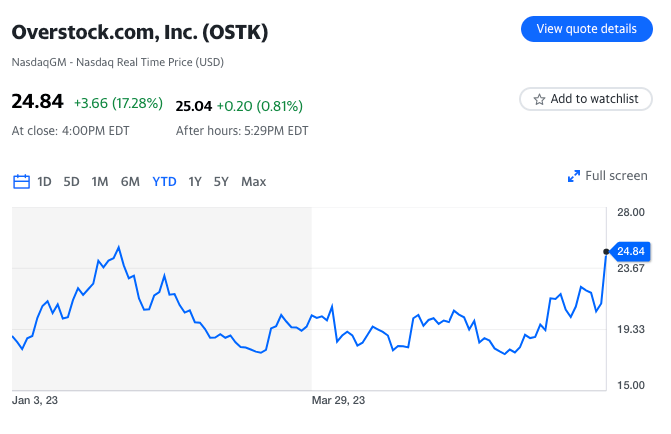

The company agreed to sell its intellectual property to Overstock.com for $21.5 million as part of its Chapter 11 bankruptcy.

Overstock will be buying its brand name, business data, and digital assets. The retails stores will all close.

Overstock investors liked the news and sent the stock up over 17%!

What is Chapter 11?

Chapter 11 bankruptcy is a form of bankruptcy that allows a business to reorganize its finances and continue operating. It is often used by businesses that are struggling financially but that have the potential to be profitable if they are given a chance to restructure their debts.

Even though BB&B filed for Chapter 11, they’re selling assets and winding down, which is typical for Chapter 7 bankruptcy.

🔐 Crypto

Bitcoin $30,156.52 (0.8%)

Ethereum $1,887.79 (0.6%)

Total market cap $1.22 T (0.6%)

Powell admits stablecoins are money

In a hearing with the U.S. House Financial Services Committee, Fed Chair Powell took questions about crypto, namely stablecoins. When asked what role the federal government has he said,

“We do see payment stablecoins as a form of money, and in all advanced economies, the ultimate source of credibility in money is the central bank…

“We believe it would be appropriate to have quite a robust federal role” in stablecoin regulation.”

What are Stablecoins? Digital tokens that are designed to be pegged to a fiat currency, such as the US dollar.

Powell’s thoughts on a CDBC

When asked about privacy concerns with a potential CDBC (Central Bank Digital Currency), he said,

“We would not support…accounts at the Federal Reserve by individuals. If we were to, and we’re a long way from this, support at some point in the future a CBDC, it would be one that we’re intermediating through the banking system and not directly at the Fed.”

Our take: Renewed institutional crypto adoption and positive sentiments from the Fed are signs crypto is slowly becoming more mainstream. The markets seem to agree with BTC up 19.0% and Ethereum up 13.7% in the past week.

More Bitcoin EFT filings

Valkyrie Funds has filed with the SEC to offer a spot Bitcoin ETF. BlackRock, WisdomTree and Invesco have also all filed in the past week.

💵 Personal Finance

In a recent video I lay out why former hedge fund manager, Raoul Pal and ARK Invest CEO, Cathie Wood, think that Bitcoin and the tech sector will perform the best over time.

💰 Be a Better Investor

Retirement is when you stop sacrificing today for a reward tomorrow.

Fun Fact - Bankrupt Origin

The word “bankrupt” comes from the Italian banca rotta, meaning “broken bench.” In Italy, money dealers worked from benches or tables. If a money dealer ran out of money, his bench or table was broken in half and he was out of business.

The word had its French equivalent, banqueroute, and subsequently made its way into the English language as both a figure of speech and a literal definition of what happened to the affected person. (Source)

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.