Good morning investors! Last week was exciting and this week may also have some surprises for us.

Today we cover:

What to look forward to this week

The changing situation of stocks

Should you contribute the max?

Be a PRO: We discussed Alphabet (Google) in yesterday’s issue of the Pro newsletter where we gave the stock a price target of $190.

The report delves into the current situation, challenges ahead, and competition, including the new search engine.

Upgrade to Pro today to get access to not just yesterday’s. issue but also all our previous issues and a special finance course written by our CEO, Trajan King.

📊 Economy and News

Things to look out this week

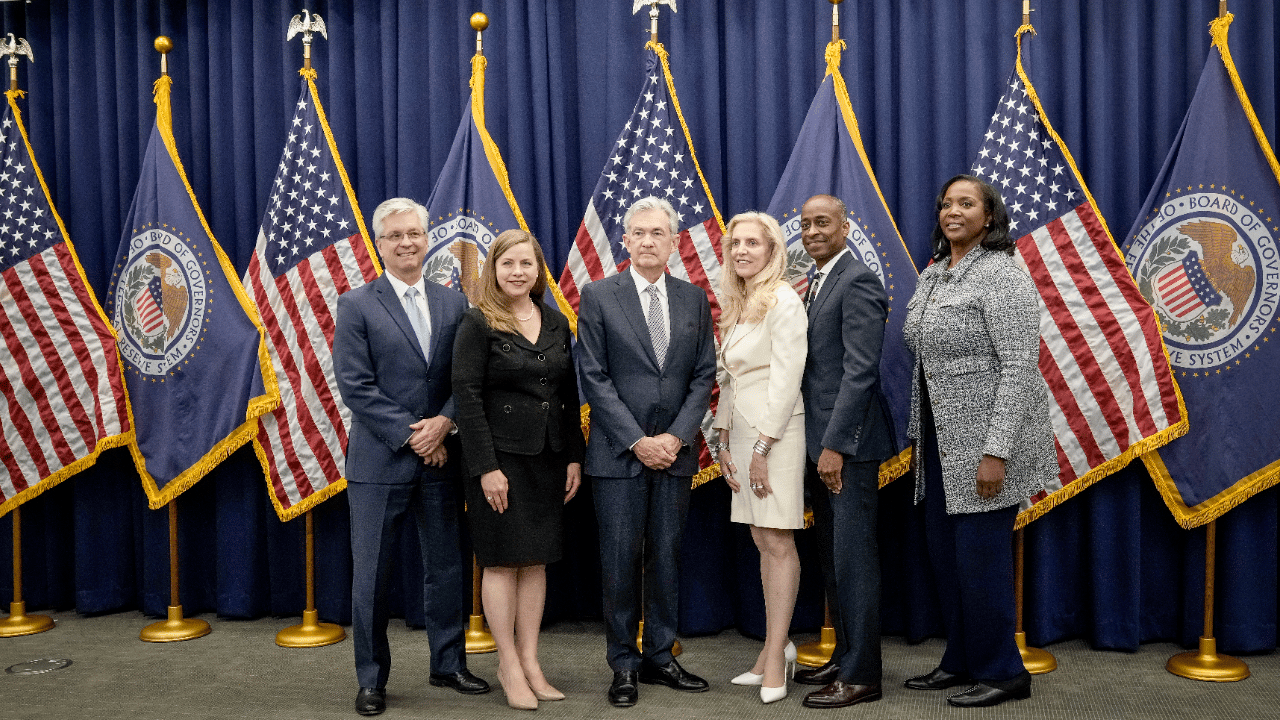

This week, U.S. interest rates may gain clarity as Federal Reserve Chair Jerome Powell speaks at the annual Jackson Hole retreat. Before that, the Democratic National Convention kicks off, global PMI data offers insights into economic conditions, and energy markets remain turbulent due to geopolitical tensions. Here's what's ahead in the markets.

Jackson Hole:

Powell will deliver the keynote at the Federal Reserve’s Jackson Hole symposium on Friday at 10:00 AM ET. Markets will closely watch for signals on the timing and pace of upcoming rate cuts. Recent positive data has lifted U.S. stocks, easing recession fears. Most expect a rate cut at the September Fed meeting, though the size—either a quarter or half-point—is still debated.

U.S. Data:

The Fed will release minutes from its July meeting on Wednesday, where Powell acknowledged inflation progress, keeping the door open for a September rate cut. Additionally, the Bureau of Labor Statistics will provide a preliminary estimate of nonfarm payroll revisions, and the weekly jobless claims report will be released Thursday. Several Fed officials, including Christopher Waller and Raphael Bostic, will also speak during the week.

Democratic Convention:

The Democratic National Convention begins Monday in Chicago, with a focus on boosting Vice President Kamala Harris' presidential campaign. As the race with Republican candidate Donald Trump tightens, Harris' policy positions, including her commitment to Federal Reserve independence, will be in the spotlight.

PMI Data:

Global PMI reports, mostly out Thursday, will give a real-time look at economic activity. July’s data indicated an economic slowdown paired with persistent inflation, especially in the U.S. and Germany, complicating central banks' decisions on future rate cuts.

Energy Markets:

Energy markets remain volatile, with crude oil prices rising above $80 a barrel due to Middle East tensions, while European gas prices fluctuate amid concerns over Russian supplies through Ukraine.

Global hits:

Barclays warns of Japan-style recession risk for China as the country plans to focus on boosting consumption to improve economy.

German government reaches deal to reduce deficit target after 2025 budget debacle.

Soft August jobs report could sway fed to deliver supersized rate cut in September.

Job data revisions: Job numbers are revised every month primarily because the initial figures are based on preliminary data that may be incomplete or subject to adjustments.

These numbers rely on surveys and data collected soon after the reference period. However, not all employers or agencies may have reported their data in time for the first release, and some of the collected data may require further validation.

As more comprehensive and accurate information becomes available in the following weeks, the figures are updated to reflect a more accurate picture of employment trends. This revision process ensures that the reported job numbers are as precise as possible, providing policymakers, economists, and the public with a reliable understanding of the labor market.

However, at times, these revisions can be major and even impact other decisions.

People are buying more: Sales at US retailers unexpectedly surged in July, the Commerce Department said Thursday, rising by a solid 1% from the prior month, up from June’s downwardly revised 0.2% decline. That trounced economists’ expectations of a 0.3% gain.

Retail sales, which are adjusted for seasonal swings but not inflation, make up a sizable chunk of overall spending. July’s reading is a boon for the US economy because the country’s economic growth hinges on Americans spending their dollars.

📈 Stocks

S&P 500 5,554.25 (+0.20%)

DJIA 40,659.76 (+0.24%)

NASDAQ 17,631.72 (+0.21%)

BRENT CRUDE 79.55 (-1.65%)

* Prices as of Aug 19th, 12:20 AM UTC

Are the bulls back?

Wall Street's Cboe Volatility Index (VIX) dropped to 15 after surging above 65 last Monday, marking its largest single-day increase since March 2020.

Despite this calm, investors remain on high alert, closely watching economic data ahead of the Federal Reserve's September meeting, according to Geoffrey Strotman, Senior Vice President at Segal Marco Advisors. The Fed will consider the July Personal Consumption Expenditures price index, along with August labor and inflation data, before making its policy decision on September 18.

While traders are anticipating a rate cut in September, some Fed officials have recently signaled a more cautious stance. Although recent economic data has paved the way for a potential rate reduction, it's uncertain whether the Fed will lower rates by a quarter-point or half-point. The likelihood of a half-point cut in September has decreased to 26% from 51% a week earlier, based on the CME FedWatch Tool.

The Russell 2000 index, which tracks U.S. small-cap stocks, rose 3% last week as traders speculated on a September rate cut. Small-cap stocks typically perform well following the Fed's first rate cut in an easing cycle.

It seems that investors once again have confidence in the economy.

More mortgage: Mortgage applications surged 17% last week, driven by homeowners seeking to refinance, up by a staggering 35%.

Mortgage rates plummeted last week to their lowest level in more than a year, according to figures from mortgage financing giant Freddie Mac.

Disappointing: Disney, Fox, Warner Bros. Discovery sports streaming venture launch blocked by federal judge in win for Fubo .

💵 Personal Finance

Should you contribute the max?

Now that we know that the IRS has increased contribution limits, it’s time to think if we should max out our retirement accounts.

There is no one word answer.

Maxing out is good in most cases, but not always. We suggest that you decide ‘how much to contribute’ based on these factors:

Non-retirement goals

Don’t just consider retirement goals, look at non-retirement goals as well. Here’s a checklist to look at:

Get rid of debt.

Build an emergency fund.

Get insurance, including health insurance, long-term care insurance, disability insurance, and life insurance, and ensure it is adequate.

Establish a will or trust.

We suggest that you complete these goals before considering to maxing out a retirement plan. Also, a lot depends on your personal goals. For example, some individuals might prefer to own a house than to max out 401(k) contributions.

Reminder: Contribute the minimum (at least) to get your employer’s match for a company-sponsored retirement plan, if it’s offered

Look at alternatives

There might be some more interesting investment options out there, so consider those too. Fees and taxes play a vital role in this aspect.

If the fees in your employer-sponsored plan are high, consider directing any additional funds to a traditional or Roth IRA. However, if you find yourself with extra money after maxing out your IRA accounts, it may be beneficial to reinvest it in your 401(k).

When choosing between the traditional and Roth variety of an IRA or 401(k), the difference comes down to when you’ll be taxed. For example, with Roth accounts, contributions are made after taxes but retirement distributions are tax-free.

You will enjoy even more benefits such as a broader assortment of investments, including ETFs.

Summary: Max out your retirement accounts if you can do it without being in debt and giving up on other (important) goals.

Some people even consider cryptocurrencies an alternative. In fact, about 44% of Americans with retirement savings have invested in cryptocurrency.

Bitcoin has ben one of the best performing assets this year, so it might be a good idea to consider it but we suggest that you first understand the economy and where the price is heading.

We talked about Bitcoin in last week’s Pro newsletter and called it a ‘buy’, you can still read the issue by subscribing for FREE. Don’t miss out on great investment opportunities.

💰 Be a Better Investor

Resources:

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.