Good morning investors! Experts say that both stocks and crypto might go lower this week, so be prepared.

Today we cover:

Everyone’s losing jobs.

Homes are getting more affordable.

Reasons to invest in real estate.

Follow us on Twitter for more.

🔈 Audio version: Apple Podcasts | Spotify | YouTube. | Discord

📊 Economy and News

Job cuts at highest since dot-com crash

Over 50,000 employees have been laid off from more than 200 tech firms this year so far, continuing on the trend that started in 2023.

Over 260,000 workers from nearly 1,200 tech companies were let go in the previous year, including big names like Alphabet, Amazon, Meta, and Microsoft. Even smaller firms like Canva, eBay, Unity Software, SAP, and Cisco fired a huge number of workers.

This made 2023 the worst year since the 2001 crash for the tech industry in terms of layoffs.

Wall Street has largely applauded these cost-cutting measures, pushing many tech stocks to record highs. However, this can be very problematic for people who have been let off.

February 2024 saw the highest number of job cuts for that month since 2009, during the financial crisis, when companies focused on preserving cash. The problem, however, is that people are struggling to find jobs because everyone’s firing workers.

AI is largely to be blamed for this, but it’s also offering new opportunities. Moreover, workers are worried. The demand and pay for AI engineers is on the rise with salaries jumping 12% from the third to fourth quarter last year, now standing at $190,000.

Global hits:

FDA approves Madrigal Pharmaceuticals drug as the first treatment for common NASH liver disease.

How the climate crisis will affect the U.S. economy.

Mega Millions jackpot climbs to an estimated $875 million after no grand prize winners Friday.

What topic would you like the next webinar to be on?

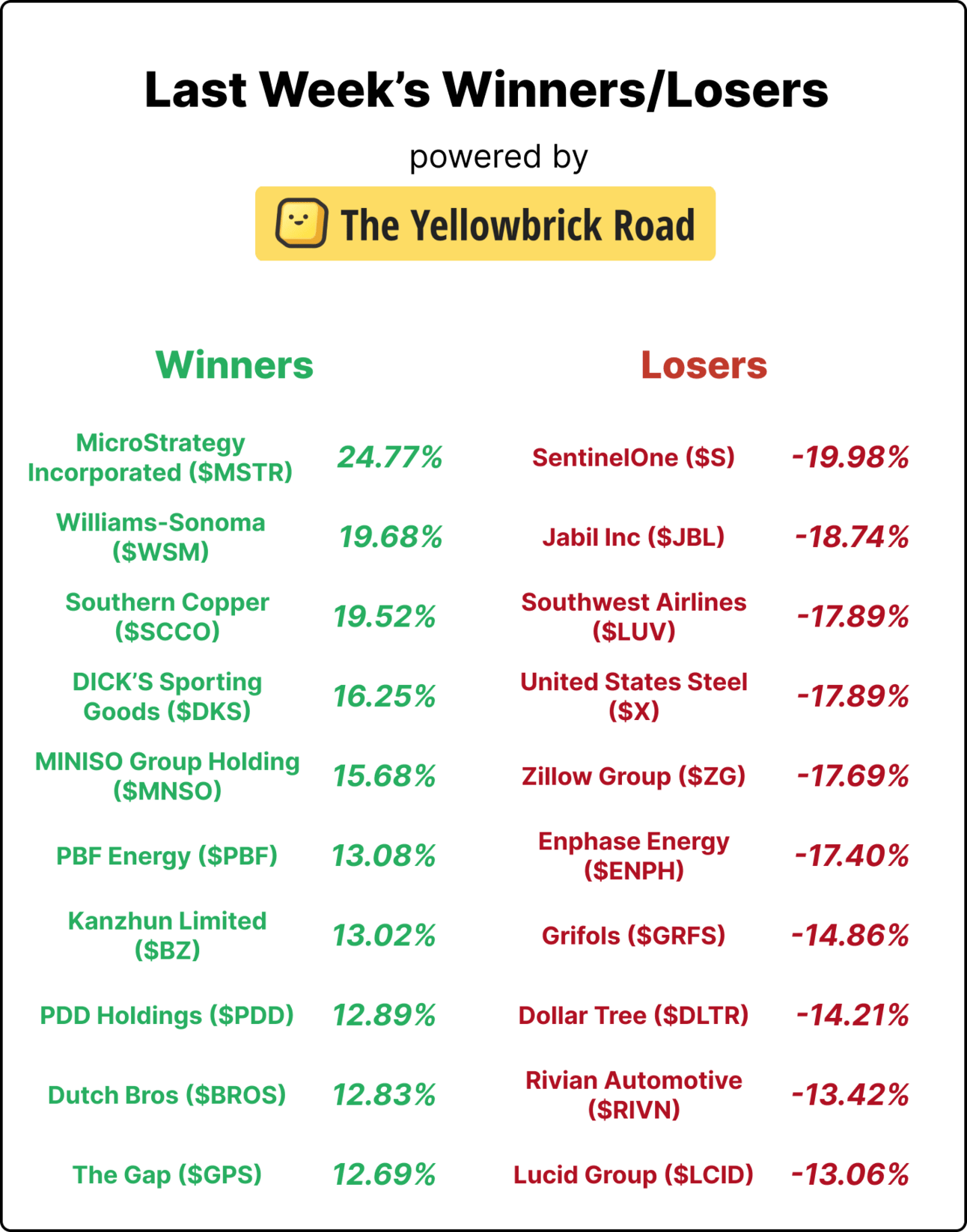

📈 Stocks

S&P 500 5,117.09 (-0.65%)

DJIA 38,714.77 (-0.49%)

NASDAQ 17,808.25 (-1.15%)

BRENT CRUDE 85.43 (-0.55%)

* Prices as of Mar 18th, 12:20 AM UTC

Homes to get more affordable?

Home prices are not falling yet but buyers and sellers will now pay less when trading homes.

The National Association of Realtors has reached a settlement with groups of homesellers, agreeing to end landmark antitrust lawsuits by paying $418 million in damages and eliminating rules on commissions.

There will now be new rules in place to protect buyers and sellers:

NAR will prohibit agents' compensation from being included on listings placed on local centralized listing portals, known as multiple listing services. This will stop brokers from pushing more expensive homes.

NAR will end requirements for brokers to subscribe to multiple listing services, many of which are owned by NAR subsidiaries.

Buyers' brokers will be required to enter into written agreements with their buyers.

The impact: Americans currently pay over $25,000 in brokerage fees for the average-priced American home that goes for $417,000. Now with new rules, these costs could fall by between $6,000 and $12,000.

Settlements: Tesla has settled with Black worker who won two trials over racist discrimination. Furthermore, it has agreed to pay $42 million for employee crash that injured motorcyclist.

Moreover, Apple has reached a $490 million settlement over Tim Cook’s China sales comments.

Shocker: Family Dollar and Dollar Tree will close 1,000 stores.

🔐 Crypto

Bitcoin $68,142 (+4.44%)

Ethereum $3,628 (+3.09%)

Total market cap $2.59T (+2.55%)

* Prices as of Mar 18th, 12:20 AM UTC

All about crypto

Bitcoin is now back under $70K after hitting highs last week. Here’s more you need to know about digital coins:

Solana has surpassed Ethereum and other EVM-based Layer-2 solutions in 24-hour volume.

Book of Meme skyrockets 345% in 24 hours, Binance jumps on the bandwagon.

Indian Finance Minister says that crypto isn't currency and adds that G20 must regulate the use of digital currencies.

Experts think Bitcoin could go down below $60K.

💵 Personal Finance

Why invest in real estate

Real estate investing can be a great way to build wealth over the long term. Here are some of the advantages of investing in real estate:

Potential for high returns: Real estate has historically outperformed other asset classes, such as stocks and bonds, over the long term. This is because real estate is a tangible asset that is not subject to the same volatility as the stock market.

Where to invest? Choose states where prices are affordable and increasing. New York, for example, has a very high appreciation rate – up to 15% in some areas – but it is not a very affordable option as the average house in the state costs over $700,000.

Texas can be a better option with affordable rates and great growth potential. Some other good states include Maine and Connecticut where homes appear to be appreciating at a rate of 8%, more than double when compared to the country’s average of 3%.

Cash flow: Rental properties can generate positive cash flow, which can be used to offset the cost of the mortgage, taxes, and other expenses.

The average apartment rent in the U.S. is $1702, which is a decent amount of money. Moreover, it can increase easily if you have a good house in a decent location.

Tax benefits: Real estate investors can take advantage of a number of tax breaks. Here are some of the top write offs and deductions investors enjoy:

Passive Income & Pass-Through Deductions

Depreciation

Capital Gains

1031 Exchange

Self-Employment/FICA Tax

Tax-Deferred Retirement Accounts

Opportunity Zones

Appreciation: Real estate values tend to appreciate over time, which can lead to significant profits when the property is sold. The market appears to be ready to go down, which makes it a good time to invest.

Special Rates: You might be eligible for special mortgage rates if you are buying a property with the intention to use it as your primary house. Furthermore, there may be some other conditions, such as no previous home ownership.

The government wants to increase homeownership rate in the country, which currently stands at 66%.

Diversification: Real estate can help to diversify your investment portfolio and reduce your risk. Since real estate protects against inflation, it can prove to be a good option. Furthermore, you can diversify more by turning to real estate ETFs.

Also, don’t forget we’re on YouTube. Give us a subscribe and check one of our top videos here:

💰 Be a Better Investor

“I don't look to jump over 7-foot bars: I look around for 1-foot bars that I can step over.”

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.