Good morning investors! All sectors closed higher yesterday but Bitcoin is now under $42,000.

Today we cover:

Homes are getting expensive.

Preparing stocks for 2024.

Getting rid of student loans.

Follow us on Twitter for more.

🔈 Audio version: Apple Podcasts | Spotify | YouTube

📊 Economy and News

Homes got more expensive in October

US home prices continued to rise in October, hitting a new record high and marking the ninth-consecutive month of increases.

Prices rose 4.8% in October compared with October 2022. That’s a jump from the 4% annual increase in September and marks the strongest annual gain seen in 2023. Moreover, this marked the strongest national growth rate since 2022.

The strength came despite a very high rate in October. Low inventory is the major reason why prices have been going up. People that could absorb higher mortgage rates or who were paying cash competed for the few homes available. Combined with the fear from many buyers that if they don’t buy now, interest rates could increase even more, prices moved higher.

States to know about: Detroit reported the largest YOY gain at 8.1% followed by San Diego with a 7.2% increase and then New York with a 7.1% gain. Only one city saw a decline – Portland, Oregon, down 0.6%, versus a year ago.

What about the future? Experts are divided. Some expect prices to go up due to increased demand in 2024, and some see a small decline due to improved inventory.

Global hits:

Intel will build $25 billion chip factory in Israel’s ‘largest investment ever’.

Taylor Swift had the best year for any business leader in recent memory.

Apple files appeal after Biden administration allows U.S. ban on watch imports.

📈 Stocks

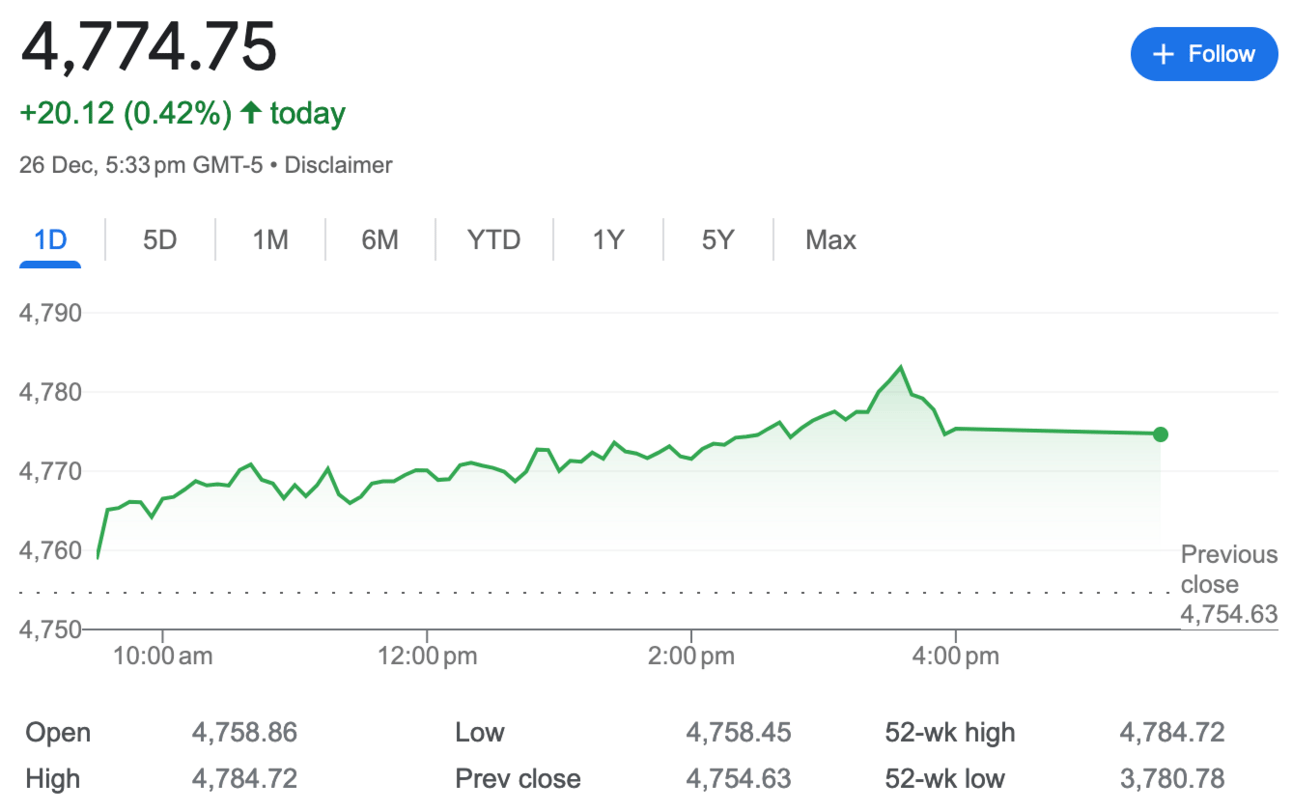

S&P 500 4,774.75 (+0.42%)

DJIA 37,545.33 (+0.43%)

NASDAQ 16,878.46 (+0.60%)

BRENT CRUDE 81.16 (+0.11%)

* Prices as of Dec 27th, 12:20 AM UTC

Industries to keep an eye on in 2024

U.S. stocks gained yesterday making it the eight consecutive week of growth. The S&P is just 22 points shy of its all-time high set in January of 2022.

The last week of December is about to come to a close and it’s time to prepare for the next year.

Experts think 2024 will be the year of the streaming bundle. These happenings could impact major names like Disney and Netflix. We also suggest you to keep an eye on vehicle stocks since major changes are expected.

The demand for e-vehicles is expected to increase next year. This makes it a good time to consider stocks like GM, Tesla, and Nio. However, choosing one can be a little tricky because not only are most companies working on new products, some also have plans to enter new markets, which could change the dynamics in 2024. For example, Japan is investing $4.3 billion in Thailand over the next five year to help it achieve carbon neutrality. Plus, we might see major price changes with cheaper options hitting the market.

Also, the pharma industry may have some surprises next year. Some major buy outs and mergers have occurred this year, including yesterday’s announcement of AstraZeneca buying China-based cell therapy biotech Gracell for $1.2 billion.

Another industry to keep an eye on next year is the chip industry, i.e.: Intel and Nvidia, among others. Furthermore, you should pay special attention to companies that have strong links to China since the geopolitical situation could change things.

Reminder: Retailers are doing away with the ‘free return’ policy.

Which industry has the most potential in 2024?

Sponsored by

Auto Insurance: Overpriced!

Just because you have to renew your auto insurance every 6 months does not mean you have to overpay!

The sad truth: 50% of U.S. drivers overpay for their auto insurance.

There are 3 SIMPLE steps to solve the problem:

Step 1) Visit our page on this

Step 2) Enter your Zip Code, fill out a 1-page form

You will really enjoy the benefits of this simple process; you no longer have to be in the 50% that overpays!

💵 Personal Finance

Struggling to get rid of student loans? Check your options

People are struggling to make loan payments and only about 60% with student loans had paid by mid-November when the bills resumed after a gap of three years.

The situation impacts a large number of people. Outstanding education debt stands at $1.7 trillion, more than credit card or auto debt with the average loan balance standing at $30,000. In fact, around 7% of student loan borrowers owe more than $100,000.

The government is taking steps to make things right. It has introduced a 12-month “on ramp” to repayment, during which borrowers are shielded from the worst consequences of falling behind.

But, you may have some other options too:

Deferments

See if you are eligible for deferments. It helps save money (no interest is accrued) and offers greater ease. There are several options, including unemployment deferment and economic hardship deferment. You must meet certain requirements to qualify for these. For example, you must be receiving certain types of federal or state aid to qualify for hardship deferment.

Other options include the graduate fellowship deferment, the military service and post-active duty deferment, and the cancer treatment deferment.

The maximum benefit from an unemployment or hardship deferment for only up to three years, per type.

Forbearances

This option allows borrowers to keep their loans on hold for up to three years. Consider this option only if deferment is not available since this option is costly due to interest.

We suggest that you try to keep up with your interest payments during the pause to prevent your debt from increasing.

Income-driven repayment plans

These schemes limit your monthly payments to a fraction of your discretionary income and grant forgiveness for any outstanding debt after 20 or 25 years.

Introduced by the Biden administration, this option enables borrowers to contribute only 5% of their discretionary income towards their undergraduate student loans, with some individuals having a monthly bill as low as $0.

Check this video for more:

💰 Be a Better Investor

“If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume.”

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.