Good morning Pros! In today’s issue, we’re diving deep into Roku—is this overlooked tech gem a buy? Our proprietary analysis reveals one critical factor that could drive 20%+ gains (or losses) in the next 12 months as we uncover whether Roku’s recent 22% surge is a breakout or a bull trap.

Then we’ll show you how to turn Nvidia’s climb toward all-time highs into real cash flow using a proven options strategy with limited risk and a $300 profit potential. (We’ll show you exactly how to set it up.)

We’ll also break down the most overbought and oversold stocks right now based on RSI data — essential intel for timing your next trades.

And to wrap things up, a deep dive on Birkenstock, the surprisingly resilient “tariff-proof” stock that just crushed earnings and may have more upside ahead.

🛑 Surprised to see an issue on Sunday?

This is a special preview of our Pro edition—designed to give you a taste of the premium insights you're missing out on.

Not interested in upgrading? No problem. You’ll continue to receive our free daily newsletter as usual.… but we still think upgrading comes with great value (and a 7 day trial for new users!).

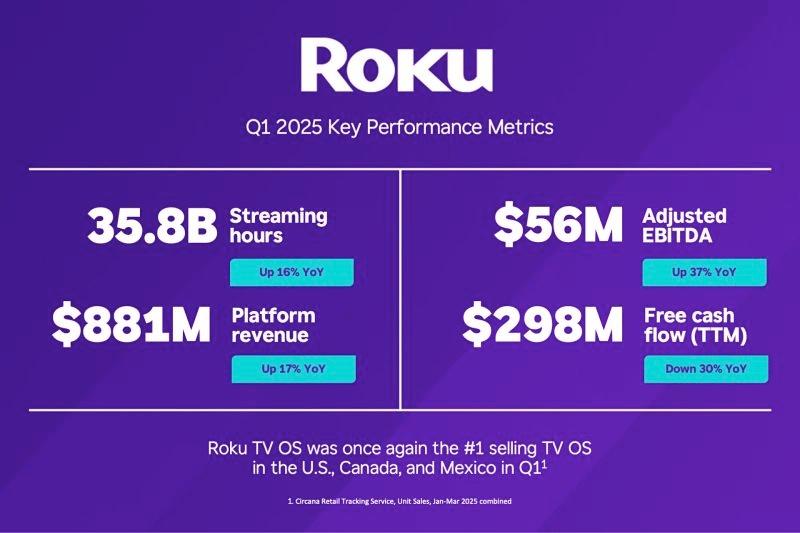

📊 Stock analysis: Is Roku a buy?

Roku is a tech company that often gets ignored due to bigger names but deserves credit as it has established a following. But, is there more potential? Let’s find out.

The current situation:

Roku is trading at $71.37.

The stock has a 52-week high of $104 and a 52-week low of $48.

It is down 4% YTD and up 16% in the last 12 months.

The stock has skyrocketed in the last 30 days and is up 22% in May.

The stock trades about 70% below its July 2021 peak.

What experts say: The average price target is $86.20 with a high forecast of $130 and a low forecast of $60. The average price target represents a 23.02% change from the last price of $70.

Subscribe to Pro Membership to read the rest.

Become a paying subscriber of Pro Membership to get access to this post and other subscriber-only content.

UpgradeA subscription gets you:

- Weekly stock deep dive

- Archived presentations and deep dives articles.

- Q&A with investors

- 100% off financial freedom course ($497 value)