Good morning Pros! In today’s issue, we see if Shake Shack is a buy and also talk about Visa, which is our Investment of the Week.

Get the most out of your membership

You can log into the archive to see what stocks we’ve covered recently.

Access the Financial Freedom Retirement course:

📊 Stock analysis: Is Shake Shack a buy?

Shake Shack makes delicious burgers but does it make for a good investment? Let's find out.

The current situation:

The stock is trading at $91.85.

Shake Shack has a 52-week high of $144.65 and a 52-week low of $72.93.

The company enjoys a P/E ratio of 202.87.

It is up 1% in the last 6 months but down 31% YTD.

What experts say: Based on 18 Wall Street analysts offering 12 month price targets for Shake Shack in the last 3 months. The average price target is $115.87 with a high forecast of $160 and a low forecast of $86. The average price target represents a 26.74% change from the last price of $91.42.

Why the stock has fallen?

Shake Shack’s stock has gained 81.4%, and over five years, it has delivered a 23.5% return. However, 2025 has been a bad year.

Shake Shack’s 31% year-to-date decline in 2025 stems from a combination of macroeconomic pressures and company-specific challenges. Rising operational costs, particularly in labor and food inflation, have squeezed margins in the hospitality sector, impacting fast-casual chains like Shake Shack.

Supply chain disruptions have further strained profitability, as ingredient costs remain elevated. Additionally, consumer spending has softened due to economic uncertainty, with diners cutting back on discretionary purchases like dining out.

Moreover, Shake Shack’s aggressive expansion, including new locations and investments in digital ordering, has increased capital expenditures, reducing short-term free cash flow and raising investor concerns about near-term profitability.

Valuation Insights: Is Shake Shack Undervalued or Overvalued?

Discounted Cash Flow (DCF) Analysis: A Case for Undervaluation

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting future free cash flows and discounting them to present value. For Shake Shack, current Free Cash Flow (FCF) stands at $17.49 million, with analyst estimates and Simply Wall St projections forecasting growth to $389 million by 2035.

Using the 2 Stage Free Cash Flow to Equity approach, the DCF model values Shake Shack at $99.28 per share. At the current price of $86.76 (as of October 2025), the stock trades at a 12.6% discount, suggesting the market may be underestimating its long-term cash flow potential.

Result: UNDERVALUED

Price-to-Sales (P/S) Ratio: A Signal of Overvaluation

The P/S ratio offers a practical lens for valuing companies like Shake Shack, where earnings can be volatile. Shake Shack’s current P/S ratio is 2.64x, above the hospitality industry average of 1.62x but below the peer average of 3.34x. Simply Wall St’s Fair Ratio, which adjusts for factors like earnings growth, company size, profit margins, and risks, calculates a fair P/S ratio of 1.90x for Shake Shack.

With the actual ratio at 2.64x, the stock appears overvalued based on sales metrics, as investors are paying a premium relative to these adjusted benchmarks.

Result: OVERVALUED

Balancing the Metrics

Shake Shack’s valuation presents a mixed picture. The DCF model suggests undervaluation, pointing to strong future cash flow potential, while the P/S ratio indicates overvaluation relative to sales. With a value score of 2 out of 6, Shake Shack passes only two key valuation tests, placing it in a gray area for value investors. This discrepancy underscores the need to weigh both growth potential and current pricing carefully.

Solid Same-Store Sales and Rising Free Cash Flow Signal Shake Shack’s Growing Strength

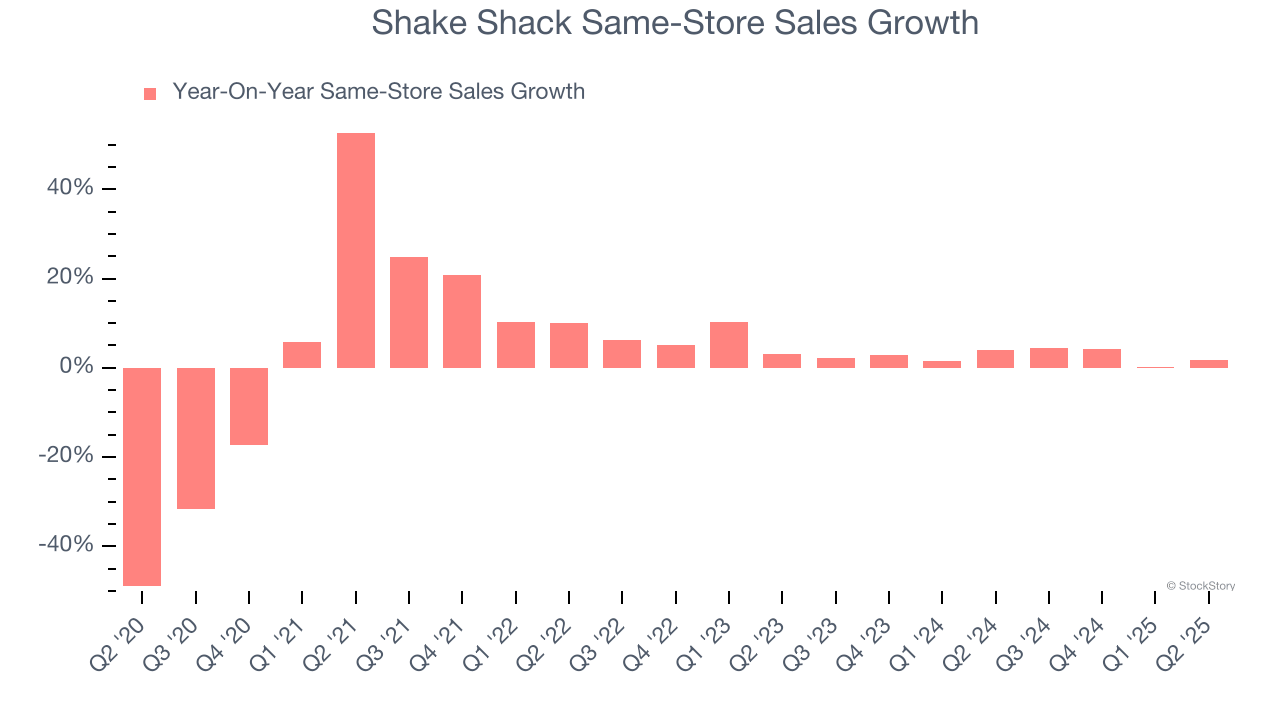

Same-store sales, a critical measure of organic growth for restaurants open at least a year, reflect Shake Shack’s robust demand. Over the past two years, the company has achieved an average annual same-store sales growth of 2.7%, showcasing steady customer demand for a fast-casual chain.

Complementing this, Shake Shack’s free cash flow (FCF) margin, a reliable indicator of financial health as it accounts for all operating and capital expenses, expanded by 2.1 percentage points over the last year to reach 3.5% for the trailing 12 months. This improvement highlights Shake Shack’s shift toward a less capital-intensive business, as FCF profitability rose despite flat operating profitability. Together, strong same-store sales and growing FCF margins point to increasing demand and operational efficiency, positioning Shake Shack favorably for future growth.

But we have reasons to doubt

Shake Shack’s recent business quality is strong, but past profitability was weak, with a five-year average ROIC of -1.2%, indicating losses during expansion efforts.

Is it a buy?

We suggest that you avoid this name for now. Increasing beef prices and supply chain challenges are expected to put pressure on the company.

📰 Investment of the Week: Visa

Set to announce earnings on 28-Oct, Visa is our Investment of the Week.

Revenues are expected to grow by about 10% year-over-year to $10.6 billion, per consensus estimates, while earnings are projected to come in at about $2.97 per share. Growth is expected to be driven by solid payment volumes, supported by resilient consumer spending across both discretionary and nondiscretionary categories. Cross-border payments, in particular, are likely to remain a key source of strength. Value-added services (VAS) are also likely to remain a significant driver of its growth trajectory. Over Q3 FY’25, VAS revenue grew by 26% year-over-year led by AI-driven fraud detection, real-time analytics, digital checkouts, and other payment security solutions.

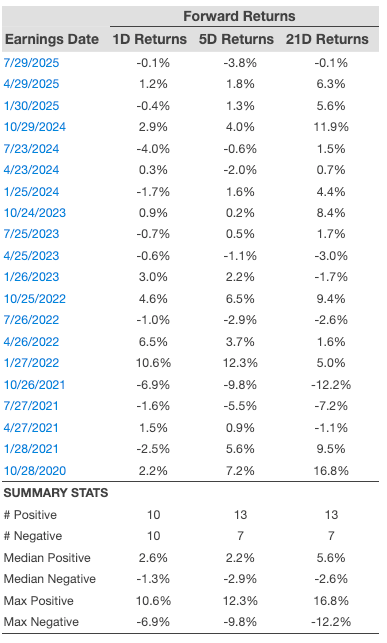

There are 20 earnings data points recorded over the last five years, with 10 positive and 10 negative one-day (1D) returns observed.

Additional data for observed 5-Day (5D) and 21-Day (21D) returns post earnings are summarized along with the statistics in the table below.

The options market overestimated V stocks earnings move 92% of the time in the last 12 quarters. The predicted move after earnings announcement was ±3.5% on average vs an average of the actual earnings moves of 1.7%.

V historically moved higher heading into earnings more often than not. On average, the stock gained 1.8% for the 2 week period before earnings (based on the last 12 quarters of data).

V shares have moved higher in the immediate aftermath of earnings 6 out of 12 previous reports. On average the stock moved up 0.5% in the first day of trading after the company reported earnings.

Based on this, it’s a 50-50 chance. So be careful when buying or selling this.

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.