Good morning investors! The market was mixed yesterday with news coming from different sectors.

Today we cover:

No rate cut

A look at the GDP

Microsoft and Meta beat

Embarrassed by your stained toilet? Not anymore! Transform your toilet from grimy to sparkly clean with Splash Foam's revolutionary cleaning formula.

No heavy scrubbing needed. Just pour in, let the foam cleaner work its magic, and flush to reveal a sparkling, bright, shiny toilet that looks brand new! See why over 1 million satisfied customers everywhere are calling Splash Foaming Cleaner a game-changer.

Should there be a rate cut in September?

📊 Economy and News

Fed Holds Rates Steady Amid Trump Pressure, Signals No September Cut

The Federal Reserve voted 9-2 to maintain the federal funds rate at 4.25%-4.5%, despite President Trump's push for significant cuts.

Governors Michelle Bowman and Christopher Waller dissented, advocating for easing due to controlled inflation and a potentially weakening labor market.

Fed Chair Jerome Powell noted no decision has been made for September, with markets adjusting expectations for a rate cut to 46% from 64%.

Recent data shows 3% GDP growth and inflation at 2.1%, close to the Fed’s 2% target. Trump’s criticism continues, targeting Powell and Fed spending, while economic indicators suggest a solid but moderating economy.

Global hits:

BOJ to be cautiously upbeat, keep rates steady as trade gloom lifts. Similarly, Bank of Canada holds rates steady and says global trade war risk has eased

Euro zone economy ekes out better-than-expected 0.1% growth in second quarter

Trump signals openness to $500 million settlement with Harvard.

Russian consumer price index falls for second consecutive week.

Tariff news: Trump says Friday tariff deadline ‘will not be extended’ as the US reaches oil development deal with Pakistan. Furthermore, Trump plans to impose a Russia ‘penalty’ on India in addition to a 25% tariff as trade talks stall.

President Trump signed an executive order eliminating the duty-free de minimis exemption for low-value shipments, aiming to close a "catastrophic loophole" exploited by countries to bypass tariffs and smuggle deadly synthetic opioids into the United States.

Also, there is now an additional 40% tariff on Brazil.

Furthermore, copper prices plummeted in one of the largest single-day drops ever recorded after President Trump imposed a 50% tariff on imports of semi-finished copper products. Additionally, he invoked the Defense Production Act, mandating that 25% of high-quality copper scrap and raw copper produced in the U.S. be sold domestically.

Lastly, the US now has a trade deal with South Korea, setting tariffs at 15%.

The GDP: Gross domestic product jumped 3% for the second quarter, better than the 2.3% estimate and reversing a 0.5% decline in the prior period. Consumer spending rose 1.4% in the second quarter, better than the 0.5% in the prior period. While exports declined 1.8% during the period, imports fell 30.3%, reversing a 37.9% surge in Q1.

We must mention that this figure grossly overstated the economy’s health as declining imports accounted for the bulk of the improvement and domestic demand increased at its slowest pace in 2-1/2 years.

Rental market: The national multifamily vacancy rate rose to 7.1% in July. Rents were down 0.8% from July of last year. Regionally, rents were up in July from June in 37 of the nation’s 54 metropolitan areas with a population of more than 1 million.

Sponsored by Roku

Find your customers on Roku this Black Friday

As with any digital ad campaign, the important thing is to reach streaming audiences who will convert. To that end, Roku’s self-service Ads Manager stands ready with powerful segmentation and targeting options. After all, you know your customers, and we know our streaming audience.

Worried it’s too late to spin up new Black Friday creative? With Roku Ads Manager, you can easily import and augment existing creative assets from your social channels. We also have AI-assisted upscaling, so every ad is primed for CTV.

Once you’ve done this, then you can easily set up A/B tests to flight different creative variants and Black Friday offers. If you’re a Shopify brand, you can even run shoppable ads directly on-screen so viewers can purchase with just a click of their Roku remote.

Bonus: we’re gifting you $5K in ad credits when you spend your first $5K on Roku Ads Manager. Just sign up and use code GET5K. Terms apply.

📈 Stocks

S&P 500 6,362.90 (-0.12%)

DJIA 44,461.28 (-0.38%)

NASDAQ 21,129.67 (+0.15%)

BRENT CRUDE 73.31 (+0.43%)

* Prices as of Jul 31st, 12:20 AM UTC

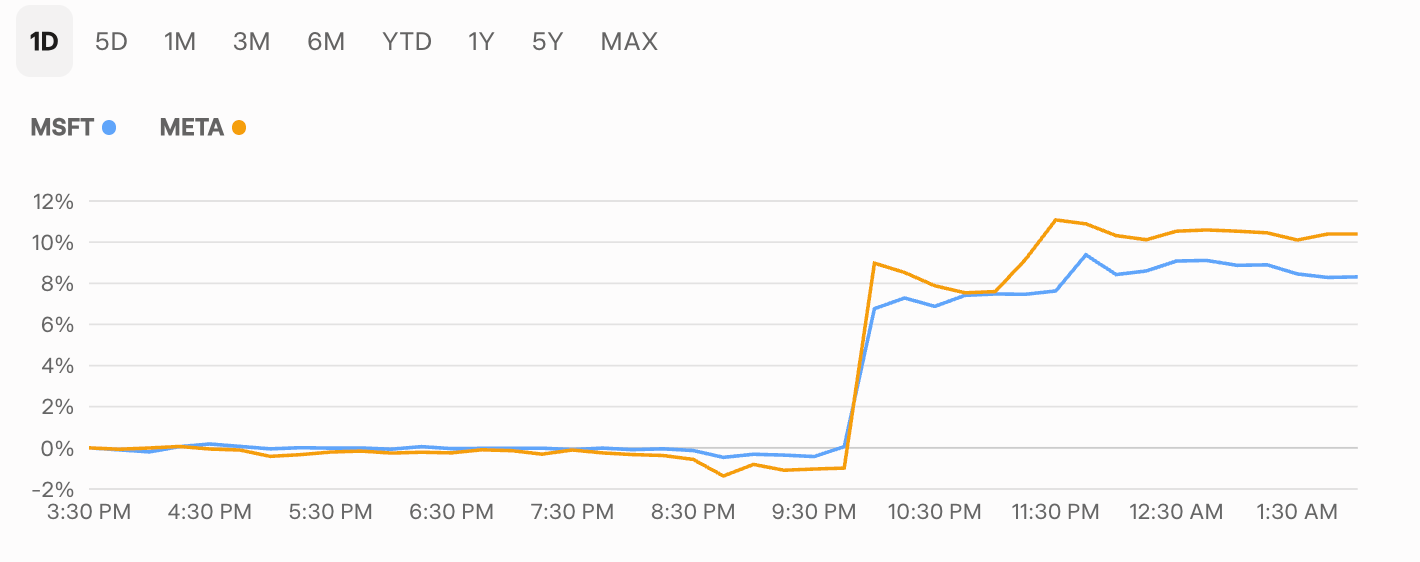

Microsoft and Meta Surge to Record Highs on Stellar Earnings

Microsoft's stock jumped 9%, pushing its market cap past $4 trillion after a robust beat-and-raise quarter. The company reported earnings per share of $3.65 and revenue of $76.44 billion, exceeding analyst expectations of $3.37 and $73.81 billion.

Its operating margin hit 46.6%, beating consensus by 90 basis points, even with a hefty $30 billion in capital expenditures.

The Intelligent Cloud unit, powered by Azure, saw a 26% year-over-year revenue increase, with Azure alone generating over $75 billion, up 34% from last year—its scale revealed for the first time. Despite data center infrastructure shortages, Microsoft is aggressively investing to address supply-demand imbalances.

Similarly, Meta's stock soared after a double-beat quarter and an optimistic forecast. The company delivered earnings per share of $7.14 on $47.52 billion in revenue, topping estimates of $5.92 and $44.80 billion. Its Q3 sales guidance of $47.5 to $50.5 billion also outpaced the $46.14 billion expected.

Meta is pouring resources into AI infrastructure, noting that hiring-related compensation will be a key driver of expense growth, projecting a higher year-over-year expense increase in 2026 compared to 2025.

Controversial: Google said that it would sign the EU AI code of practice. The code provides guidance on how to meet the requirements of the EU’s landmark AI Act. It comes after Meta refused to sign the code over fears it could stifle European AI innovation.

Also, Adidas said that it had faced a double-digit million euro hit from U.S. tariffs in the second quarter. The sports retailer said that added costs associated with tariffs could total 200 million euros ($231 million) in the second half of this year. The company also flagged potential risks to consumer demand should U.S. tariffs set off a surge in inflation.

Exciting: iPhone maker Foxconn joins $1 trillion AI data center market with new alliance. Elsewhere, JPMorgan to enable crypto purchases via credit cards in Coinbase tie-up. Moreover, Figma priced its IPO at $33, which is $1 above the top end of its expected range.

Etsy shares climbed 4% as the company reported modestly stronger consumer spending across all its cohorts, while minimizing concerns about potential tariff impacts.

Samsung: Samsung reported a second-quarter revenue of 74.6 trillion Korean won, a slight increase from 74.07 trillion won in the same period last year. However, its operating profit for the quarter fell sharply to 4.7 trillion won from 10.44 trillion won a year earlier. The Device Solutions division saw a significant 93.8% year-over-year decline in operating profit.

💵 Personal Finance

Embracing AI Uncertainty: A Mindful Approach to Career Control

Feeling anxious about AI taking your job? You’re not alone. AI’s growing capabilities in tasks like diagnosing diseases, coding, and project management can spark worry, anxiety, and fear (WAF).

These emotions signal a desire to control an uncertain future. While WAF can motivate action in controllable situations, like studying for an exam, it’s less helpful when the future—like AI’s impact—is unpredictable.

To reduce WAF and regain control, focus on the present with these steps:

Acknowledge Your Need for Control: Recognize your desire to shape your career’s future.

Focus on the Present: Shift attention to what you can control now—your current use of AI.

Use AI Intentionally: Ask, “What do I want to do with AI today?” For example, use AI to gain insights, like tips for approaching negotiations with optimism rather than cynicism.

By focusing on what you can control now, you build a constructive relationship with AI, reduce stress, and move from fear to desire. This shift helps you live well with uncertainty and sets you up for future success.

💰 Be a Better Investor

"The investor’s chief problem—and even his worst enemy—is likely to be himself."

Think you know stocks?

Pro puts your instincts to the test with our Bull vs Bear AI stock advisor. Plus: exclusive deep dives, smarter tools, and zero fluff.

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.