Good morning investors! Yesterday was an interesting day as the market started on a strong note but closed in red.

Today we cover:

US consumers are very confident.

Micron prepares to jump ahead.

Saving for retirement.

Follow us on Twitter for more.

🔈 Audio version: Apple Podcasts | Spotify | YouTube

📊 Economy and News

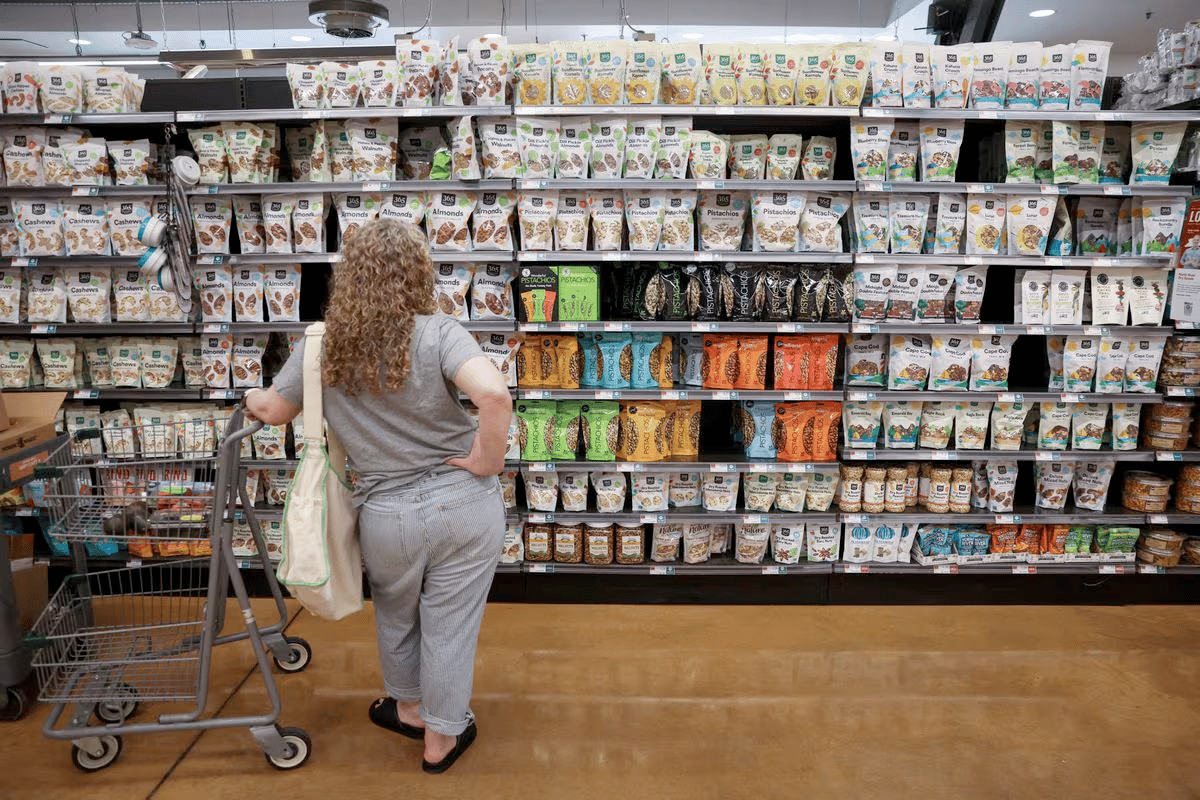

Consumer Confidence rose nearly 10% in December

Consumer confidence surged to 110.7, marking the second straight month of gains after last month's revised figure of 101.0. This is higher than the estimated figure of 104.5 and also the largest surge since early 2021.

What does it mean? It indicates consumers are back and more excited than ever. The holiday season played a major role in pushing the figures.

Retail sales rose 0.3%, in November from October, when sales fell 0.2%. December is expected to do as well due to increased interest in buying.

Consumer spending accounts for about 70% of the country’s economic activity. A major fall in it can impact a number of sectors and the country's GDP.

Any other good news? Americans are gaining confidence in the economy and expectations of a recession have declined to the lowest level so far this year. However, about two-thirds of Americans still see a possible downturn next year.

Expectations from not just income but also the labor market and business are up, from 77.4 in October to 85.6 in December. A reading below 80 for future expectations historically signals a recession within a year.

The labor-market sentiment is showing impressive gains. The share of consumers who said jobs were plentiful rose to a five-month high.

But why? Falling energy prices and lowering interest rates played key roles in keeping people ‘happy’.

The latest report highlighted a surge in the number of people looking to buy a car, home, or big appliances. However, we must add that most Americans are counting on interest rates falling further in 2024.

Global hits:

Airbnb admits misleading Australian customers by charging in USD instead of local currency.

Toyota’s Daihatsu to halt all vehicle shipments as safety scandal widens.

Boeing wins key clearance from China’s aviation regulator on 737 Max deliveries.

Surprise: US oil production is now at an all-time high of 13.3 million barrels per day. Moreover, 2022 had the lowest total unemployment rate ever.

📈 Stocks

S&P 500 4,698.35 (-1.47%)

DJIA 37,082.01 (-1.27%)

NASDAQ 16,554.16 (-1.53%)

BRENT CRUDE 79.95 (+0.31%)

* Prices as of Dec 21st, 12:20 AM UTC

Micron gives exciting results

Micron is up 5.78% pre-market after the company reported stellar earnings for its first quarter of Fiscal Year 2024.

Earnings per share came in at -$0.95, beating analysts’ consensus estimate of a loss of $1 per share. Meanwhile, revenues of $4.73 billion topped the $4.58 billion consensus estimates.

Guidance: For the current quarter, Micron predicted an adjusted loss of 28 cents a share on sales of $5.3 billion. That's based on the midpoint of its outlook.

Wall Street had been looking for Micron to lose 62 cents a share on sales of $4.97 billion in its fiscal second quarter. In the year-earlier period, Micron lost $1.91 a share on sales of $3.69 billion.

The future: The management expects the company to return to profitability next year after facing pandemic and supply related challenges.

Investors have shown great faith in the company but reports say that they are now eager to make a profit. Although Micron shares have kept pace with the semiconductor industry’s broader ETF ($SOXX), its total return over most other timeframes has lagged significantly.

Warning: The stock market closed in red yesterday (for no major reason) indicating investors have started to ‘walk away with profits’.

Also check: Alibaba makes leadership changes after bruising by rival’s success. Plus, Warner Bros. and Discovery are in talks to merge with Paramount Global.

Sponsored by Danelfin

Danelfin, just named “Best Financial Research Company” at the Benzinga Global Fintech Awards, brings AI technology, once reserved for hedge funds and elite investors, to everyone, revolutionizing stock picking.

Danelfin brings AI technology, once reserved for hedge funds and elite investors, to everyone, revolutionizing stock picking.

Danelfin AI rates the probability of beating the market over the next 3 months, with up to a 94% win rate.

Strong Buy AI picks have outperformed the market every year by an impressive +20.08% on average since 2017.

The AI-powered Danelfin Best Stocks strategy delivered a remarkable +191% return between Jan. 3, 2017, and Aug. 15, 2023. During the same period, the S&P 500 delivered a +118% return.

💵 Personal Finance

Planning for retirement

It doesn’t matter what stage you are in, it’s important to start retirement planning now. We emphasize this even if you have no plans to retire in the near future.

Even big and successful entrepreneurs, such as Warren Buffett, who do not plan to retire anytime soon indulge in retirement planning.

The image below shows when the average American retires:

The image below shows how much the average American retiree has:

Unfortunately, most people don’t plan well for retirement and won’t have enough money. Don’t be like them. Don’t solely look at this data and try to hit the number by age. That would leave you unprepared.

Instead, answer these questions:

How much do you need to retire? Don’t look at averages or how much others are saving, decide based on the type of life you wish to live once you hang the boots. You can use this formula to decide how much you need to retire.

When do you wish to retire? As seen above, most people start to retire in their 50s but a growing number of people are retiring at a young age and some are working beyond their 60s.

See how much you have to save per month to reach your retirement goal. Remember that something is better than nothing. Merely saving $100 per month can give you $12,000 by the end of the year. Moreover, you can increase this amount by investing smartly.

Decide how and where you intend to save. Consider investing in a 401(k) or similar account if your employer offers that option. Start as high as you can and gradually expand your contributions toward the IRS limit that stands at $22,500, or $30,000 for those 50 or older. Also, be very careful about what you keep in your retirement account. Some good options include index funds and precious metals as they’re safe and less volatile than options like stocks and digital coins.

Spend a good amount of time on the retirement section when creating a financial plan because it impacts how happy you will be in your later years and what you’ll be able to do.

Check this incredible video for more tips:

💰 Be a Better Investor

“Value investing is at its core the marriage of a contrarian streak and a calculator.”

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.