Good morning investors! This week we will again be looking out for some big names such as Coca Cola and Shopify as they’re set to announce earnings.

Today we cover:

The debt crisis.

S&P Index hits a new benchmark.

Investing in property

Follow us on Twitter for more.

🔈 Audio version: Apple Podcasts | Spotify | YouTube

📊 Economy and News

'A slow fiscal death awaits some countries,' warns experts

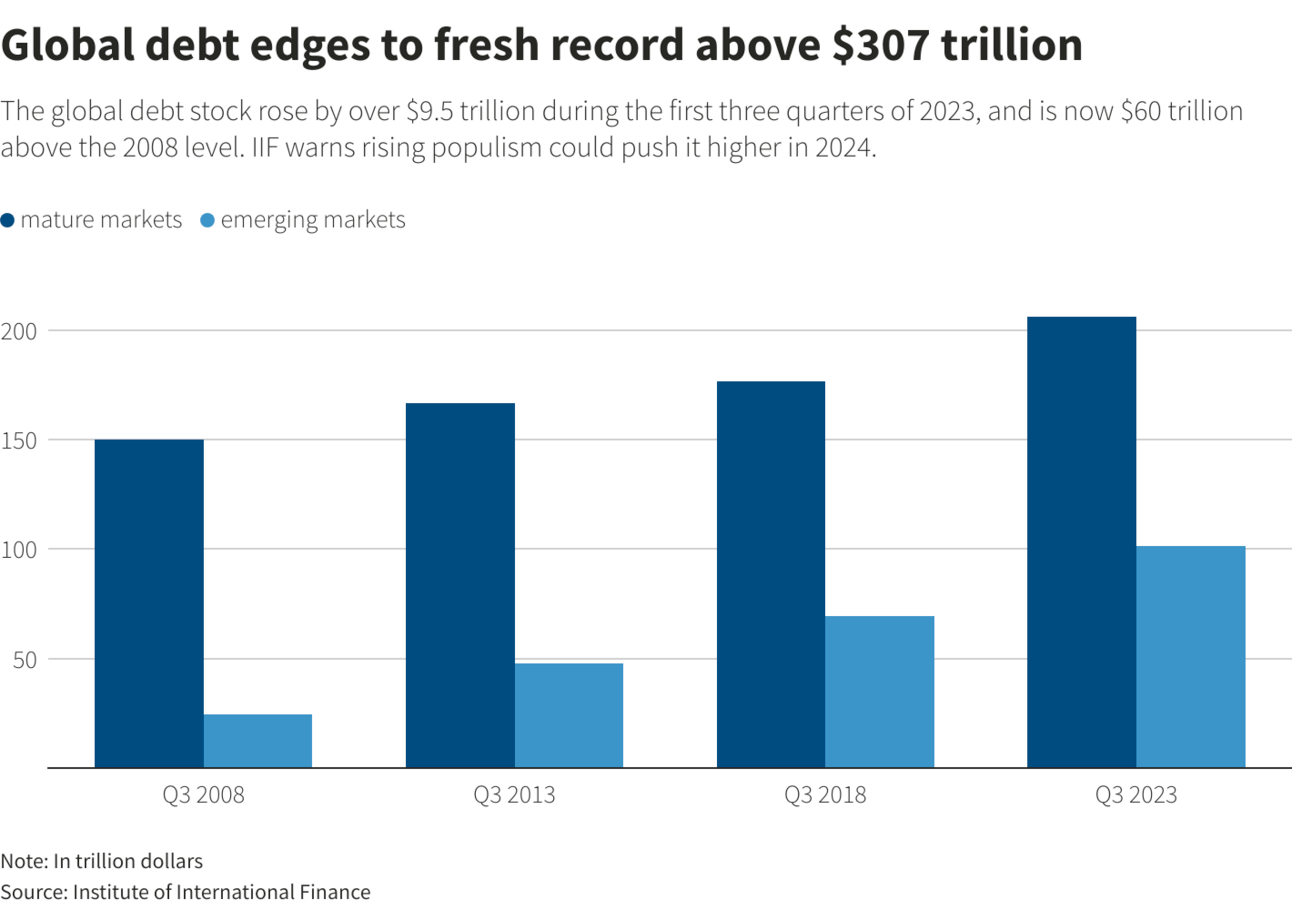

Global debt hit a record of $307.4 trillion in the third quarter of 2023, with a substantial increase in both high-income countries and emerging markets.

While some countries are set to recover, experts think some will have a very difficult time in the next few years due to the debt crisis.

About 100 countries will be forced to “cut spending on critical social infrastructure including health, education and social protection” in order to meet debt obligations.

“I would expect that some of the bigger countries that don’t address their debt issues will die a slow fiscal death,” said economist Arthur Laffer Jr.

Mature and growing markets such as India, the US, Japan, and China played a very important role in these increases. He said that countries will have only two solutions: to increase taxes or grow the economy faster than the debt rate.

Countries like Sri Lanka, Pakistan, Lebanon, and Zimbabwe went or almost went bankrupt in recent times. Some experts believe that more countries may end up in a similar situation in the next ten years.

Global hits:

Investors in the Airbnb arbitrage business allege they were defrauded in scheme promising ‘higher returns than the stock market’.

Israel’s credit rating downgraded because of the war with Hamas.

Amazon wins exclusive streaming rights for NFL playoff game.

📈 Stocks

S&P 500 5,026.61 (+0.56%)

DJIA 38,671.69 (-0.14%)

NASDAQ 17,962.40 (+1.01%)

BRENT CRUDE 82.19 (+0.69%)

* Prices as of Feb 11th, 12:20 AM UTC

S&P 500 closes above key 5,000 level for first time

The S&P 500 closed above the 5,000 level on Friday for the first time, almost reaching its 2024 target in the second month of the year. It presently has a target of 5,700 in 2025, but now that things have sped up, experts may change their predictions.

For the week, the S&P added 1.4%, while the Nasdaq’s gained 2.3%. Both indices notched their fifth straight winning week and 14th winning week in 15. The Dow finished 0.1% lower.

Great earnings, slowing inflation, and a strong labor market are some of the main drivers.

“A close above this closely watched level will undoubtedly create headlines and further feed fear of missing out (FOMO) emotions,” said Adam Turnquist, chief technical strategist at LPL Financial. “Outside of a potential sentiment boost, round numbers such as 5,000 often provide a psychological area of support or resistance for the market.”

Big tech has played a major role in pushing the S&P to record highs. Meta and Nvidia have gained 35.18% and 49.75% YTD, respectively.

The S&P 500 took 41 years to reach its first major milestone of 1,000, which it hit on February 2, 1998. It reached 4,000 on April 1, 2021, after the Fed slashed rates to almost zero.

It took the index about three years to go from 4,000 to 5,000 and some are expecting it to reach 6,000 by 2025.

Sponsored by Savvy Trader

Discover the World's Best Portfolios

Introducing Savvy Trader – the ultimate investment platform! Explore diverse portfolios with detailed information about every holding and every transaction. Receive instant notifications via text, email, or in-app alerts for every trade a portfolio makes. Savvy Trader’s cutting-edge system ensures real-time and accurate portfolio performance tracking.

Join Savvy Trader for a transparent and informed trading experience – invest smarter, stay informed, and thrive in the dynamic world of finance!

💵 Personal Finance

Things to consider when buying a home (for investment)

Real estate is a great investment. It offers high returns, not only in the form of rent but also capital appreciation.

However, you have to be careful when buying a property. Here’s what to remember:

The location

This factor decides your rental income, the type of people you will work with, and your vacancy rate. Some neighborhoods are more in demand than others, and you should ideally look for a neighborhood that’s in demand so that your home doesn’t stay vacant for too long.

Also, remember that some towns discourage rental conversions by imposing exorbitant permit fees and piling on red tape.

Taxes

You will have to pay a variety of taxes on your property. There is no way to avoid taxes but you can play smart by doing some research and knowing about expected tax increases.

Avoid regions that are known to put excessive tax pressure.

Facilities

You should ideally buy a home in a neighborhood that offers facilities such as schools, hospitals, parks, and more. Homes closer to such locations tend to generate more interest. Furthermore, also look at what kind of developments are expected.

Are new buildings such as big malls being constructed?

Is the government spending on new metro system?

Such changes can boost value and help you in the future.

Safety

No body wants a house in a neighborhood that isn’t safe, so do your research and look at factors such as homicide rate, theft rate, etc. Look whether such activity is on the rise or decline.

In addition, you should also look at how prone the region is to natural disasters. Storms, for example, are very common in some parts of the US, Canada, etc. The same goes for fires in Australia. You should idealy stay away from neighborhoods that

Other than this, pay attention to the job market. Towns that pay well and offer good jobs are more in demand than towns where jobs are scarce. In fact, some cities are losing college graduates due to a poor job market. You don’t want to make the mistake of investing in such towns.

Next, consider the type of property. Do you want a commercial property or do you wish to invest in a residential property? Each may have more options, i.e.: a condo, a villa, or an office.

Note: see if you are eligible for discounts, i.e. if you are buying for yourself or if you are a first time home buyer.

💰 Be a Better Investor

“Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic.”

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.