Good morning investors! The market is in fear as tariffs appear to be causing havoc.

Today we cover:

Manufacturing figures

Stocks continue to decline

Saving tax money

📊 Economy and News

Tariffs Drive Manufacturing Costs Higher, Weigh on Jobs

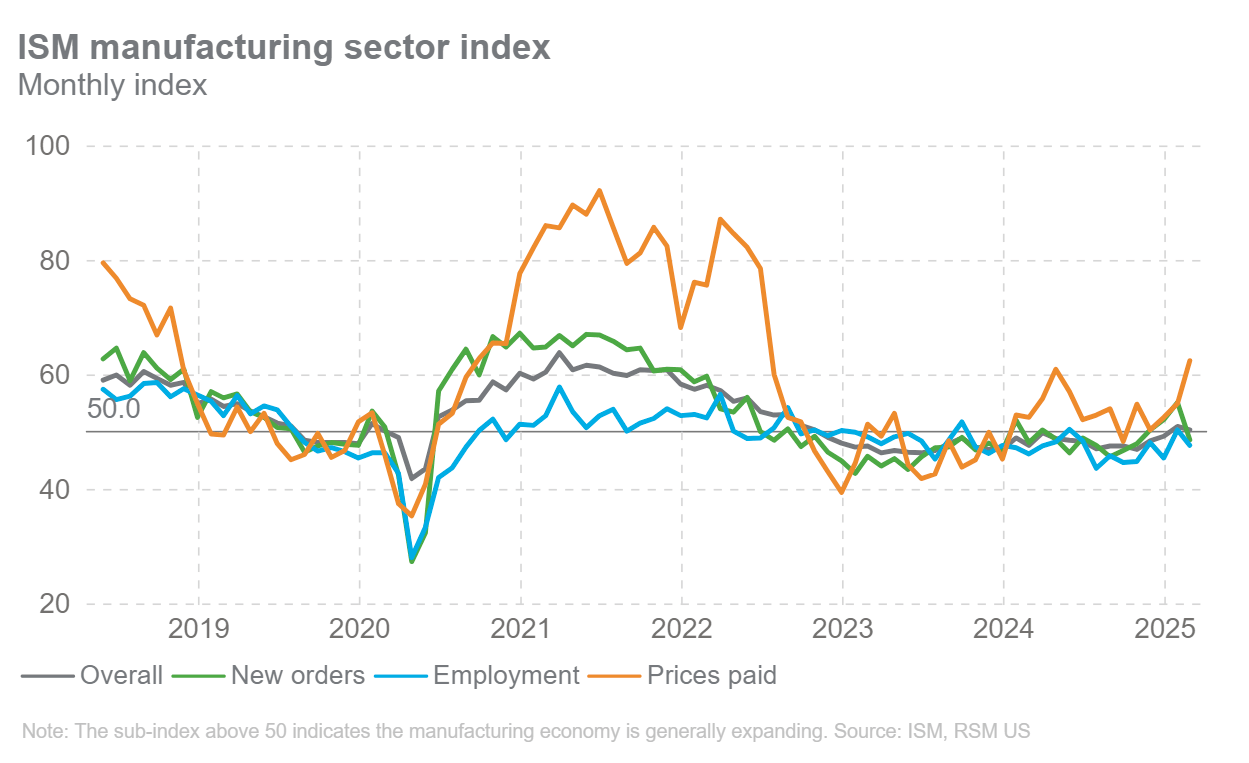

New tariffs and expectations of more hikes pushed the ISM Manufacturing Prices Paid Index to 62.4 in February, the highest since June 2022, up from 54.9 in January. While tariffs on Canada and Mexico take effect in March, companies have already adjusted prices to secure raw materials, straining supply chains and inventories.

Despite the overall ISM Manufacturing Index indicating expansion for the second consecutive month at 50.3, hiring remained weak. The employment subindex slipped back into negative territory as companies avoided long-term hiring due to uncertainty around tariffs, inflation, and pricing pressures.

With the February jobs report due Friday, the Federal Reserve will be closely watching how tariffs influence inflation and labor trends.

Global hits:

Traders place record bet on rising Japanese yen, eyeing further rate hikes.

BofA upgrades 2025 forecast for Canadian economy.

Eurozone inflation dips to 2.4% in February as ECB bets point to sixth rate cut.

Good to know: Lastly, Occidental Petroleum announced a temporary discount for exercising its outstanding public warrants. Proceeds will be used for general corporate purposes, potentially including debt repayment or redemption. Elsewhere, it is believed that OPEC+ will resume some halted production, an unexpected move that adds to the projected global oil surplus. 🛢️

Check this: The Atlanta Fed’s GDP estimate tool has plunged into negative territory, with its real-time tracker indicating a potential 1.5% decline in GDP for the first quarter. This downturn has raised concerns among investors about slowing economic growth.

During such times, it might be wise to look for an advisor.

Sponsored by Money

Are you ready? Shop around and compare policies by checking out Money's Best Car Insurance list.

📈 Stocks

S&P 500 5,849.72 (-1.76%)

DJIA 43,191.24 (-1.48%)

NASDAQ 18,350.19 (-2.64%)

BRENT CRUDE 71.42 (-1.63%)

* Prices as of Mar 3rd, 12:20 AM UTC

S&P 500 records worst day of the year thanks to tariffs

The S&P 500 declined on Monday, deepening February’s losses and turning negative for the year after President Donald Trump confirmed the implementation of new tariffs.

Stocks fell sharply in the afternoon following Trump’s reiteration that 25% levies on imports from Mexico and Canada would take effect on Tuesday, crushing hopes for a last-minute resolution. Earlier in the session, markets had been in positive territory, with the Dow climbing nearly 200 points at its peak.

Trump’s tariffs are reportedly intended to pressure North American neighbors into strengthening efforts against fentanyl trafficking and illegal immigration. At the same time, he has expressed a broader goal of reducing America’s trade imbalances and promoting domestic manufacturing.

Nvidia shares tumbled nearly 9% after the tariff announcement, bringing their price back to September levels, before the U.S. presidential election. The company, which previously reached a $3 trillion market cap, is now valued at $2.79 trillion after losing $265 billion in Monday’s slide. Trump also signed an order to impose an additional 10% duty on Chinese imports, according to an administration official.

The sell-off extended across sectors, with technology and small caps among the hardest hit. AI-related stocks like Broadcom and Super Micro Computer also fell sharply, while the small-cap-focused Russell 2000 dropped nearly 3%.

Companies vulnerable to tariffs and potential retaliation faced pressure as well. GM and Ford hit session lows following Trump’s remarks, while iShares ETFs tracking Mexico and Canada each declined more than 1%.

Exciting: AI cloud provider CoreWeave files for IPO. Elsewhere, Trump announces Taiwanese chipmaking giant TSMC to invest $100 billion in US manufacturing.

Worrisome: Singapore is investigating whether servers shipped to Malaysia, containing chips banned from China, ultimately reached the mainland. The outcome of the probe could heighten U.S. scrutiny of American equipment exports, potentially impacting sales growth.

Sunnova Crashes on "Going Concern" Warning: Sunnova Energy plunged over 63% after warning it may not have enough cash to sustain operations. The company hired a financial advisor for debt management but has already cut 15% of its workforce amid slow revenue growth.

The selloff weighed on the broader solar sector, with the ETF $TAN dropping 3% to five-year lows.

💵 Personal Finance

Bitcoin’s Drop Creates a Tax Opportunity for Investors

With Bitcoin's price declining from its record high in January, some investors have a chance to leverage tax benefits. After peaking at $109,000 on inauguration day, the cryptocurrency dropped in February and was trading around $85,000 yesterday.

This downturn presents a tax planning opportunity, particularly through a strategy known as tax-loss harvesting. This approach allows investors to offset capital gains by selling assets at a loss in taxable accounts. Once losses exceed gains, up to $3,000 can be deducted annually from regular income, with excess losses carried forward. While many wait until December to use this strategy, experts suggest acting throughout the year, especially with cryptocurrency’s volatility.

A unique advantage in the crypto market is the absence of the wash sale rule, which typically prevents investors from claiming a loss if they repurchase the same asset within 30 days. Since cryptocurrency is not currently subject to this rule, investors can sell Bitcoin at a loss and immediately buy it back, maintaining their position while still benefiting from the tax deduction.

However, this tax advantage may not last. Congressional Republicans are exploring ways to fund tax policy changes, and proposed legislation from Senators Cynthia Lummis and Kirsten Gillibrand in 2023 included closing this loophole. The Biden administration’s fiscal year 2025 budget also addressed this issue.

For now, investors can take advantage of this tax strategy, but they should always consider their long-term investment goals before making decisions.

Check this video for more:

💰 Be a Better Investor

"Making money is art and working is art and good business is the best art."

Resources:

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.