Good morning investors! Last week was exciting but ended on a low note as experts now expect the post-election rally to die down.

Today we cover:

What to expect this week

Nvidia in trouble?

Tesla to benefit?

📊 Economy and News

What to keep an eye on this week

Here’s what you need to look forward to:

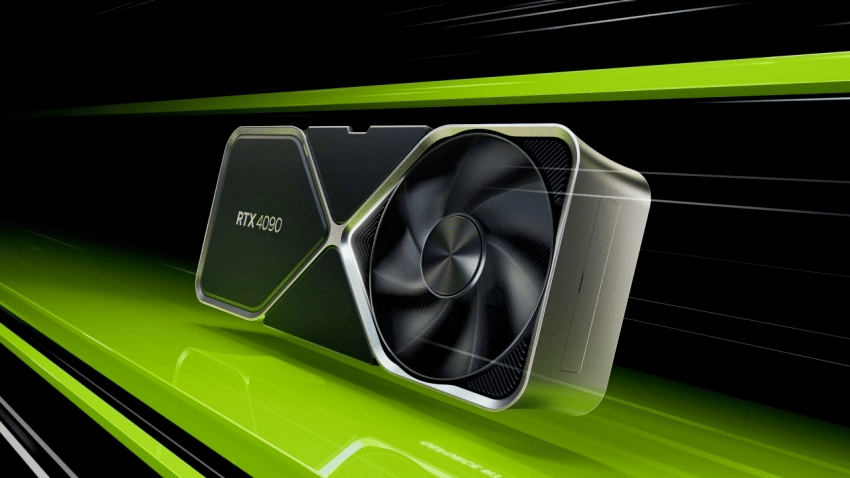

Nvidia’s Earnings to Test Market Sentiment

Chipmaker Nvidia, a leader in the AI revolution, is set to release its third-quarter earnings on Wednesday. As a major player in the S&P 500, Nvidia’s performance is closely watched, especially given its 200% stock rise this year. Investor expectations are high, suggesting potential short-term volatility. Analysts at Raymond James recently raised their price target for Nvidia, noting that any pullback could present a buying opportunity.

Crypto and more

Bitcoin has surged 30% since the U.S. election, breaking the $90,000 barrier and pushing the cryptocurrency market cap beyond $3 trillion. Market momentum is fueled by optimism over a favorable regulatory climate under the Trump administration. President-elect Trump has vowed to establish a national Bitcoin reserve, signaling a significant shift in U.S. crypto policy, though the timeline for these plans remains uncertain. But, not just BTC, even XRP is doing great and has doubled in the last 7 days, crossing the $1 mark after years.

U.S. Economic Data and Fed Commentary

The U.S. economic calendar is quieter this week, with updates on housing market health through building permits and home sales. Jobless claims and Friday's PMI reports will gauge business responses to proposed trade tariffs. Corporate earnings from Walmart and Lowe’s on Tuesday will shed light on consumer spending. Investors will also hear from Fed officials, including Chicago Fed’s Austan Goolsbee and Cleveland Fed’s Beth Hammack, for insights on monetary policy.

Oil Prices Drop Amid Demand Concerns

Oil prices fell 2% on Friday, extending weekly losses as concerns over weakening Chinese demand and slower Fed rate cuts weighed on the market. Brent and crude futures dropped 4% and 5%, respectively. Data showed reduced crude processing by Chinese refineries, signaling economic slowdown. Meanwhile, Fed Chair Jerome Powell suggested a cautious approach to future rate cuts, balancing economic growth and persistent inflation above the 2% target.

UK Inflation and Economic Indicators

The UK is set to release October CPI data on Wednesday, with economists predicting a rise to 2.2%, surpassing the Bank of England’s 2% target. This follows September’s dip to 1.7%, the first sub-target inflation in over three years. The BoE has signaled further gradual rate cuts to manage inflation pressures. Retail sales and PMI data on Friday will offer additional economic insights.

Global hits:

Most Gulf markets fall on Fed rate cut concerns.

Judge strikes down Biden overtime pay rule.

S&P revises Ireland's outlook on Apple back-tax boost; Fitch affirms ratings. Similarly, South Africa also receives a boost.

Sponsored by CompareCredit

2 Cards Charging 0% Interest Until 2026

Paying down your credit card balance can be tough with the majority of your payment going to interest. Avoid interest charges for up to 18 months with these cards.

📈 Stocks

S&P 500 5,870.62 (-1.32%)

DJIA 43,444.99 (-0.70%)

NASDAQ 18,680.12 (-2.24%)

BRENT CRUDE 71.04 (-2.09%)

* Prices as of Nov 18th, 12:20 AM UTC

Nvidia’s new chip falters

Nvidia's new Blackwell AI chips are reportedly facing overheating issues in servers, raising concerns among customers about delays in deploying new data centers, according to a report by The Information. The overheating occurs when the chips are installed in server racks designed to accommodate up to 72 units.

Sources cited in the report indicated that Nvidia has repeatedly requested design changes to the racks from its suppliers to address the problem. These challenges have involved Nvidia employees, customers, and suppliers, though the specific suppliers were not named.

In a statement to Reuters, a company spokesperson described the design adjustments as part of the normal engineering process, noting Nvidia's collaboration with leading cloud service providers as integral to its development efforts.

Tesla to benefit? The $7,500 EV tax credit may be eliminated under the incoming Trump administration, a move that could benefit Tesla and CEO Elon Musk. While the credit helps EV buyers, it indirectly supports higher pricing for electric cars competing with gasoline vehicles. When a previous version of the credit ended, Tesla reduced its prices but remained profitable—unlike legacy automakers, who admit to losing money on each EV sold.

Without the credit, EV prices might drop across the board, potentially pressuring Tesla’s profits but exacerbating losses for competitors like General Motors and Ford. Some automakers might scale back EV production to limit losses, reducing competition and potentially benefiting Tesla.

Musk has publicly supported ending the credit, arguing that Tesla’s profitability and market position make it less reliant on subsidies. Other automakers, however, have lobbied to keep the credit, citing its importance in competing with Chinese EV advancements and supporting their multibillion-dollar transition to electric vehicles.

Exciting: European SpaceX rival raises $160 million for reusable capsule to carry astronauts, cargo to space. On the other hand, Netflix said a record 60 million households worldwide tuned in for Jake Paul versus Mike Tyson fight.

Do you expect live sport to boost Netflix stock?

💵 Personal Finance

Americans are supporting adult kids

About 65% of parents with a child age 18 or over provide them with at least some financial support, according to this report.

Of those who support their over-age-22 offspring, the average monthly amount is $718. This is a huge amount of money and many parents have to dig into their retirement savings to be able to fund their child’s lifestyle.

In fact, about 33% of parents who support their adult children say it puts them under financial strain.

Most parents in the US believe that they should not 'have to spend money’ on their children after 24. Yet, they have no option but to offer financial support and nearly 43% of parents who continue to support their children in adulthood say the support is offered with no contingencies.

What to do? We understand it might not be easy to say ‘no’ to your kids. Here are a few things you can do to reduce the burden and ensure you continue to have a strong financial standing despite additional burden:

Make sure to include this financial support in your budget as an expense.

Keep an eye on your retirement account. About 20% of people who support their kids in adulthood say they have to make changes to their retirement plan every few months to be able to reach their goals.

Use rewards credit cards to earn points and save money.

Teach your kids the importance of money and educate them about credit.

More importantly, know when to say no.

Check this video for more:

💰 Be a Better Investor

“Behind every stock is a company. Find out what it’s doing.”

Resources:

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.