Good morning investors! Yesterday was a slow day as investors appear confused.

Today we cover:

The changing situation

Time for a bear market?

Getting out of credit card debt

📊 Economy and News

New reports say inflation outlook is good but some fears persist

The New York Federal Reserve's latest Survey of Consumer Expectations reveals that the three-year inflation outlook has dropped to 2.3%, marking the lowest level in a data series that began in June 2013.

Household spending is anticipated to increase by 4.9%, a slight decrease of 0.2 percentage points from June's projection. This marks the lowest expected growth rate since April 2021.

Despite concerns over a potential recession, investors have largely remained optimistic, with some analysts maintaining that U.S. economic fundamentals are still robust. However, commodity markets are providing a more cautious outlook on the global economy.

Declines in Commodity Markets

The Invesco DB Base Metals Fund has dropped over -7% in the past month, and crude oil futures have plummeted by -14% between July 5 and August 5. These declines suggest that the global economic outlook may be weakening.

Copper's Rise and Fall

Copper prices surged earlier this year on expectations of a supercycle driven by its essential role in industries like electric vehicles, semiconductors, and renewable energy. However, copper futures have since dropped by -21.4% from their 2024 peak of $5.19 per pound on May 20, now trading at $4.089 as of Monday morning.

This represents a nearly 12% decline over the past month.

China’s Economic Weakness Weighs on Markets

China's economic slowdown is having a significant impact on the prices of key commodities such as copper and oil.

Although geopolitical tensions in the Middle East have provided some support for oil prices, weak demand from China has exerted downward pressure on the market for several months.

Reflecting these concerns, OPEC reduced its global oil demand growth forecast for this year by 135,000 barrels per day, citing softening expectations from China.

U.S. and European Tariffs Add Pressure

While China's economy struggles, the U.S. is adopting protectionist measures, imposing tariffs on a range of Chinese goods including electric vehicles, batteries, semiconductors, and solar modules.

Similarly, the European Union introduced tariffs on Chinese EVs in July, prompting China to lodge a complaint with the World Trade Organization last Friday.

Global hits:

Adani Group shares shed over $2.4 billion after Hindenburg allegations against regulator.

China’s bond market is rattled as central bank squares off with bond bulls.

More than half of new cars sold in China are now electric or hybrid.

Good to know: The healthcare industry is thriving, offering greater job stability, faster wage growth and cushy perks.

📈 Stocks

S&P 500 5,344.39 (+0.0043%)

DJIA 39,357.01 (-0.36%)

NASDAQ 16,780.61 (+0.21%)

BRENT CRUDE 82.20 (+3.311%)

* Prices as of Aug 12th, 12:20 AM UTC

Bear market is coming in 2025, warns David Roche, but not everyone agrees

Veteran investor David Roche expects a bear market in 2025, caused by smaller-than-expected rate cuts, a slowing U.S. economy and an AI bubble.

Those factors could cause a bear market of minus 20% in 2025, maybe starting at the end of this year, but the Fed will have room to adjust, he added.

On the other hand, one asset manager says there’s no need to fear a burst tech bubble causing a persistent downturn.

“I do not see any reason to be concerned that you’re going to enter a bearish pattern where the market is overbought and therefore people are going to sell. I just don’t see that pattern,” said Manish Singh, chief investment officer at Crossbridge Capital.

Market participants nonetheless expect further volatility in August which is traditionally a choppy month.

Macy’s gonna change things: Macy’s will set off a wave of change at malls, as it closes about 150 namesake stores across the country by early 2027.

The department store operator has long been a mall anchor, with stores that range between 200,000 and 225,000 square feet.

Mall owners could convert the former Macy’s boxes into smaller retail spaces or make more significant changes, such as adding apartments or demolishing the mall for a completely new development.

The 150 Macy's stores slated for closure in the next three years make up 25% of the banner's square footage but represent less than 10% of sales.

The store thinks that it has ‘too many locations’ and closing some is important for survival.

Interesting: According to a new report, 3 in 5 Americans falsely believe that the U.S. is currently in a recession.

Economists have wrestled with the growing disconnect between how well the economy is doing and how people feel about their financial standing.

So, did you vote yes or no above?

New car: GM has revealed redesigned GMC Terrain as brand’s entry-level model.

💵 Personal Finance

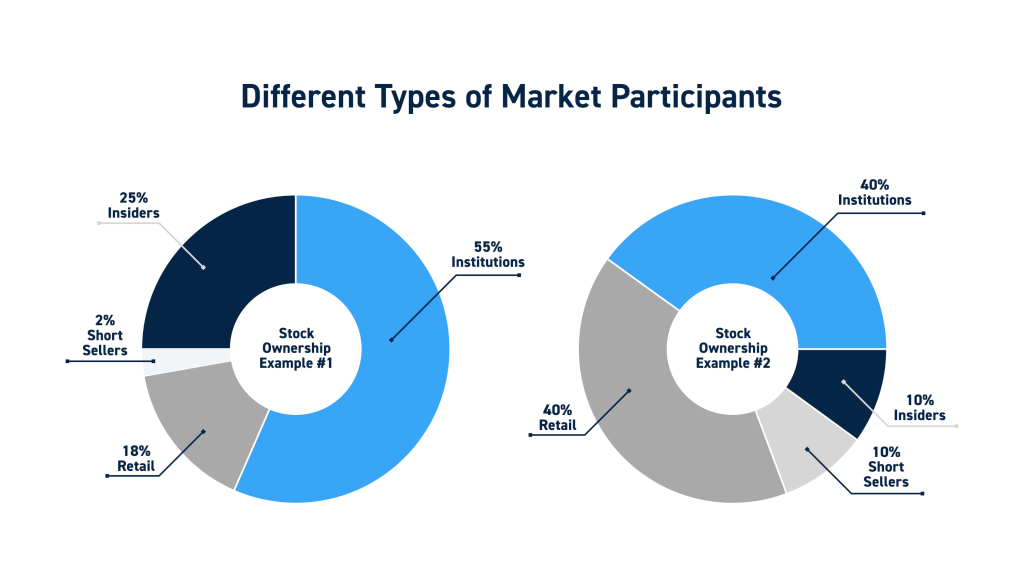

How to own stocks

About 162 million Americans, or 62% of U.S. adults, own stock. However, there’s no equal distribution as the top 1% own nearly half.

The bottom 50% of U.S. adults hold only 1% of stocks, worth $437 billion.

If you don’t yet own stock then consider making an investment. There are several ways to do so:

1. Direct Purchase of Individual Stocks

Brokerage Accounts: You can open a brokerage account with a firm (e.g., Charles Schwab, Fidelity, Robinhood) and buy individual stocks directly. You have full control over which stocks to buy, hold, or sell.

Direct Stock Purchase Plans (DSPPs): Some companies allow you to buy their stock directly without a broker. This often includes reinvesting dividends to buy more shares.

2. Mutual Funds

Actively Managed Mutual Funds: These are managed by a fund manager who makes decisions about which stocks to buy or sell. You own a portion of the fund's entire portfolio, which includes many stocks.

Index Funds: These are a type of mutual fund that tracks a specific market index (e.g., S&P 500). They typically have lower fees because they are passively managed.

3. Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on an exchange like individual stocks. They can track a specific index, sector, or theme. You can buy and sell ETFs throughout the trading day at market price.

4. Dividend Reinvestment Plans (DRIPs)

Some companies offer DRIPs, allowing you to reinvest dividends earned from your stock back into additional shares, often at no commission and sometimes at a discount.

5. Retirement Accounts

401(k) or 403(b): Many employer-sponsored retirement plans allow you to invest in stocks through mutual funds or ETFs. Contributions are often pre-tax, and the growth is tax-deferred.

In addition, you can buy stocks through Traditional or Roth IRAs, which offer tax advantages.

6. Stock Options and Employee Stock Purchase Plans (ESPPs)

Some companies grant stock options to employees, allowing them to buy shares at a set price after a certain period. Furthermore, some employers offer ESPPs, allowing employees to purchase company stock at a discount through payroll deductions.

7. Robo-Advisors

Robo-advisors are automated platforms that create and manage a diversified portfolio of stocks (usually through ETFs) based on your risk tolerance and financial goals. Examples include Betterment, Wealthfront, and M1 Finance.

Other than this, you can benefit from stock through trading platforms like XM and AvaTrade. This method allows buying fractional shares and perks like marginal trading but are riskier. Plus, you don’t usually fully own these shares.

💰 Be a Better Investor

“Although it’s easy to forget sometimes, a share is not a lottery ticket… it’s part-ownership of a business.”

Resources:

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.