Morning Download

Personal finance + economics + markets

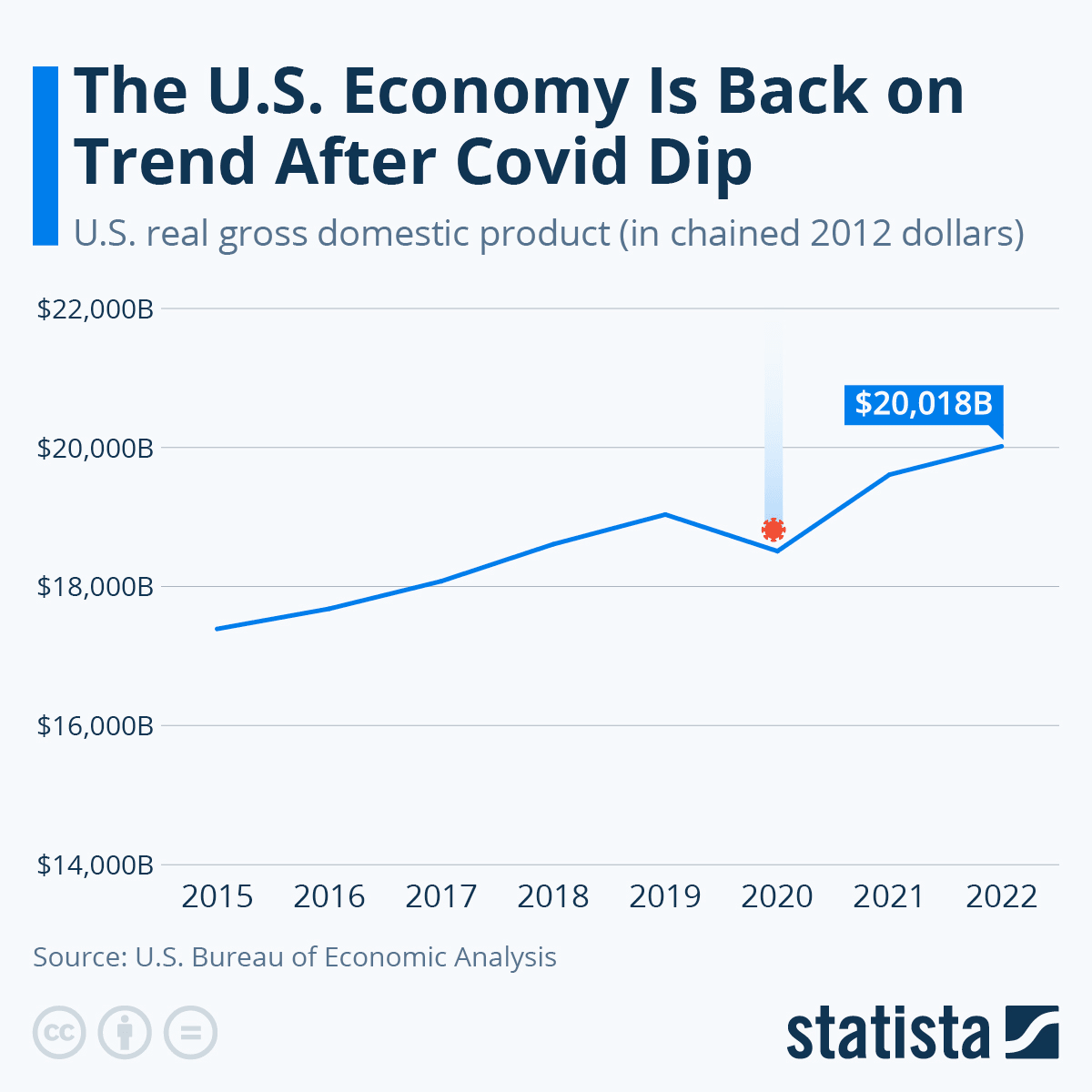

Good morning, investors! The US economy has been strong but some feel that is changing. Consider shuffling your portfolio if you’re invested heavily.

Thanks to everyone who votes in the daily polls or emails us back to tell us what you like and how we can improve. We read your feedback and make changes to get better every day!

Fun fact: The average 35-year-old in the U.S. has saved $13,000. Where do you stand?

Today we cover:

There’s trouble for the US.

The IPO market is back with a bang

Incomes that are tax free - Part II

Follow us on Twitter for more!

🔈 Audio version: Apple Podcasts | Spotify | YouTube

📊 Economy and News

There’s trouble ahead, warn experts

"I see bad signs for the U.S. economy," warned Dartmouth College Economics Professor David Blanchflower while talking to CNN.

☠️ The US in trouble? JPMorgan CEO, Jamie Dimon, also has similar views.

"While the current situation of the US economy is good, it would be a “huge mistake" to believe that it will last for years," he said while talking to CNBC.

Another report said, "The US Economy Is Bracing For Trouble".

A lot is happening and opinions are divided. Some see a rate hike, some do not expect it.

All in all, we can tell you that the market will indeed not always be as strong as it currently is. Some economies around us are falling – from Germany to China.

Is the US next? Experts believe that things will worsen but nobody can tell when.

Global hits:

ECB hikes interest rates to a new high of 4%.

European stocks closed 1.5% higher.

Chinese stocks lead foreign exodus from emerging markets.

📈 Stocks

S&P 500 4,505.10 (0.84%)

DJIA 34,907.11 (0.96%)

NASDAQ 15,473.89 (0.82%)

VIX 12.82 (-4.90%)

* Prices as of Sep 415h, 12:20 AM UTC

Arm IPO a success

Arm Holdings is now trading on the Nasdaq under the ticker “ARM.”

After selling shares at $51 each in its IPO, the stock gained 10% on its first day of trading.

The company sold about 95.5 million shares, slightly higher than expected. Mainly controlled by SoftBank, which took it private in 2016, the company price-to-earnings multiple would be over 110. Moreover, it's now valued at over $54 billion.

Meaning? This indicates tech IPOs are back, after a slow phase.

There is a backlog of roughly 200 companies that should have gone public by now, according to an analysis by PitchBook, which tracks start-ups. The success of ARM might push more companies to go this route.

🔐 Crypto

Bitcoin $26,615 (1.58%)

Ethereum $1,673 (1.82%)

Total market cap $1.06 (1.32%)

* Prices as of Sep 15th, 12:20 AM UTC

Deutsche Bank can now hold crypto for institutional clients

Bullish news for crypto! The institutions continue to arrive.

Deutsche Bank has joined hands with Taurus, a Swiss cryptocurrency firm, to offer Bitcoin and crypto custody related services to its institutional clients.

What does it mean? This adds legitimacy to Bitcoin, which is still struggling to get approved, especially in markets like China and India.

The currency, however, has become very attractive for family offices, hedge funds, and other institutional investors.

What next? Regulatory clarity around the currency is improving and we are not too far away from a working framework.

"As the digital asset space is expected to encompass trillions of dollars of assets, it's bound to be seen as one of the priorities for investors and corporations alike," said Deutsche Bank's global head of securities services, Paul Maley. "Our focus is not just on cryptocurrencies, but supporting our clients in the overall digital assets ecosystem."

💵 Personal Finance

Incomes that are tax free - Part II

Let’s start with the second and last part of our ‘Incomes That Are Tax Free’ series (part I here):

Retirement Account Income

Income from qualified retirement accounts, including 401(k) plans, IRAs, and 403(b) plans, comes with tax benefits.

In most cases, tax on your investment income is deferred until you withdraw the funds. On the other hand, withdrawals are not taxable when it comes to Roth 401(k)s and Roth 403(b)s, given that you meet all the terms and conditions.

Municipal Bond Interest

Now that bonds are again gaining popularity, it’s time to talk about the tax advantages of municipal bonds.

Bond-related income is usually taxed; however, municipal bonds, issued by states and other government entities, are an exception. You will have to pay no federal or local tax on municipal bonds-related income if you live in the state where the bonds were issued.

This exemption applies to both ETFs and individual bonds but with some limitations. ETF income, however, is subject to federal income tax but no state and local income taxes.

Financial Gifts

If you talk to a tax expert, they will tell you this ‘tax secret’.

A financial gift is tax free given that you can prove it is a ‘gift’, i.e.: you did not pay anything in return.

This applies to both the receiver and the giver as the lifetime gift tax exemption is $12.06 million for 2022 and $12.92 million for 2023.

There, however, is a caveat.

You will have to pay income tax if the gift ends up earning you income. For example, if it was a painting that you sold to make a profit or a stock that earned you dividends. You will pay tax on this additional income.

Health Savings Accounts (HSAs)

Health savings accounts offer several benefits, including tax advantages as HSA distributions are not taxable. There’s just one condition: expenses must be medical related.

Inheritances

This is a complicated area because inheritances are generally not taxable. But, there are some exceptions.

You may have to pay taxes if the estates are over a certain size. These taxes, however, are paid by the estate itself.

Exemption for 2022 stood at $12.06 million. For 2023, it is $12.92 million. You will have to pay taxes on the amount that goes above these limits.

Corporate Income Earned in 6 States

It might be a good idea to consider these six states as they levy no corporate income taxes:

Texas

Nevada

Ohio

Washington

South Dakota

Wyoming

Wyoming and South Dakota are our favorites as they have very friendly corporate tax laws. The remaining states on the list above do tax gross receipts.

Disability Insurance Payments

Disability benefits are generally taxable; however, there are some exceptions. You will not pay taxes from benefits you receive from supplemental disability insurance paid for by you, even if bought through your employer, are tax free.

Similarly, benefits you receive from a private disability insurance plan you purchased with after-tax dollars. Also, workers' compensation, including compensatory damages for all kinds of physical injuries and physical sickness, are tax free. However, punitive damages are not included.

There may be some other exceptions as well. It might be a good idea to talk to a tax specialist and learn more about how specific insurance payments are taxed.

In the meantime, check this incredible video below:

💰 Be a Better Investor

“Behind every stock is a company. Find out what it’s doing.”

What did you think of today's newsletter?

👩🏽⚖️ Legal Stuff

Nothing in this newsletter is financial advice. Always do your own research and think for yourself.